The action of the Dogecoin price (DOGE) this week has activated good deals.

The biggest jet of meme by market value, Dogecoin, dropped from almost 5% to 26 cents, according to Coindesk data. However, institutional investors seize the opportunity, which increases 680 million DOGE tokens in the middle of prices.

This wave of accumulation occurs while regulatory clarity improves on the expected approval of the first ETF of Dogecoin, classified by the United States, according to CD Analytics.

Tuesday, Cleancore Solutions announced the purchase of an additional 100 million Doge, bringing its cash titles to more than 600 million Doge.

Rex Shares-Osprey Dogecoin Etf (Doje) should be put online this week, allowing investors to expose themselves to cryptocurrency without having to own and store it.

AI key badges

- The interest of companies for Dogecoin has intensified during the period from September 16 to 17, because institutional accumulation and regulation developments surrounding the proposals of negotiated stock markets have created new investment parameters.

- Business negotiation offices watched the Doge’s $ 0.01 range, which represents a volatility of 5% between $ 0.27 of resistance and $ 0.26 in support.

- Institutional sale targeting $ 0.26, driven by an exceptional volume of 945.89 million, established business support parameters. Institutional purchases in the evening created resistance at $ 0.27 over a volume of 629.60 million, indicating business accumulation strategies.

- Confirmation of support based on volume at $ 0.26, following an immediate institutional takeover, validated the adoption thesis of companies.

- Critical resilience of the support area during the 60 -minute sales pressure demonstrates institutional commitment to current price levels.

- A technical escape from a consolidation model for several months draws the attention of the business treasury, with a price target of $ 0.50.

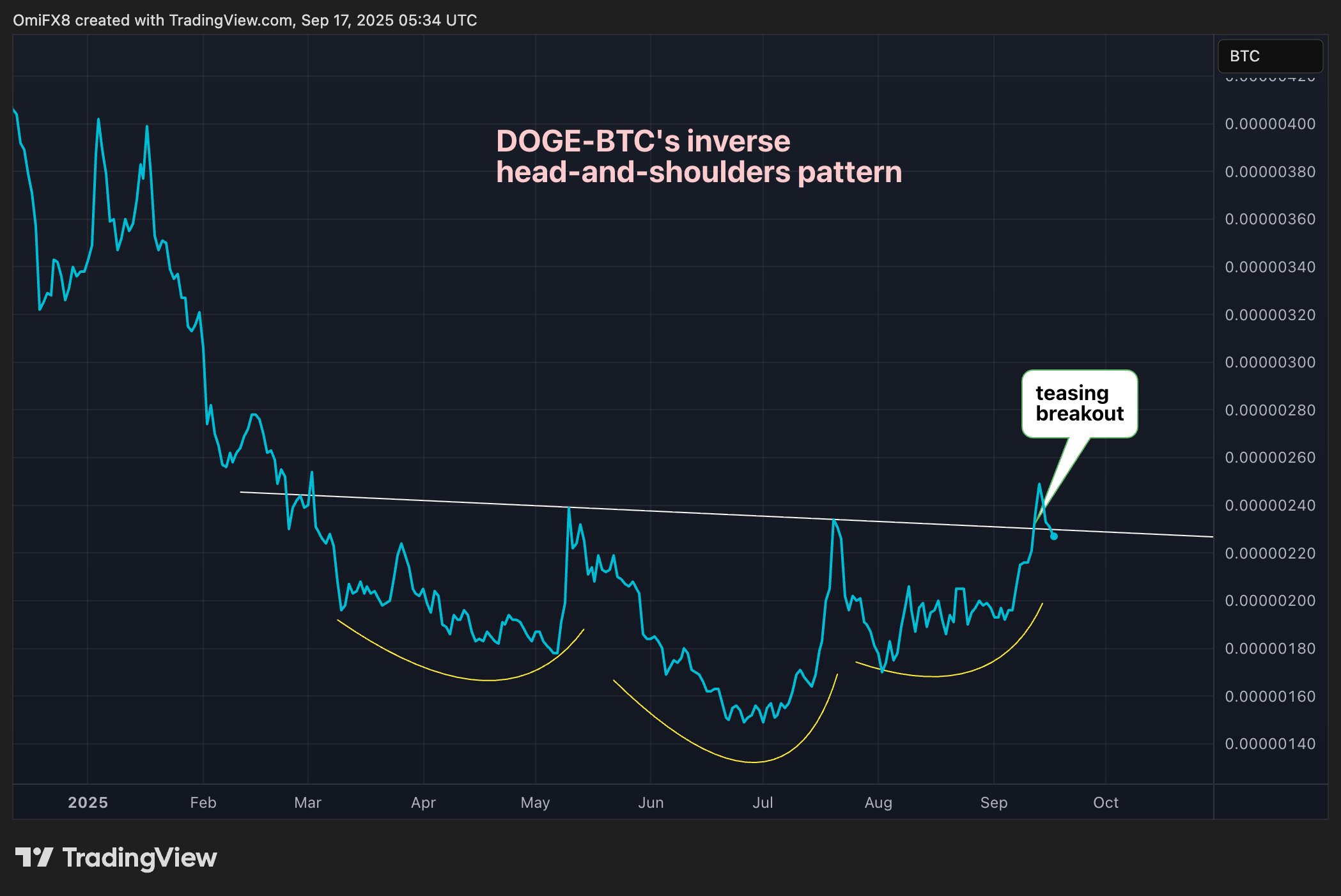

Concentrate on Doge / BTC

The Dogecoin-Bitcoin report (DOBE / BTC) could see net gains, assuming that the Fed reduction rates are scheduled for Wednesday, while laying the basics of an aggressive relaxation in the coming months.

Indeed in other words, the scene is defined for a disproportionate DOGE rally compared to BTC.

The federal reserve is expected to reduce interest rates by 25 base points to 4% later Wednesday. With traders who were drying up 99% of this decision, it is essentially cooked on the market.

This means that attention is now moving to what the Fed signals on future cuts. Doge Bulls hopes that the Fed will minimize inflation problems, referring to faster and more aggressive rate reductions in the coming months.