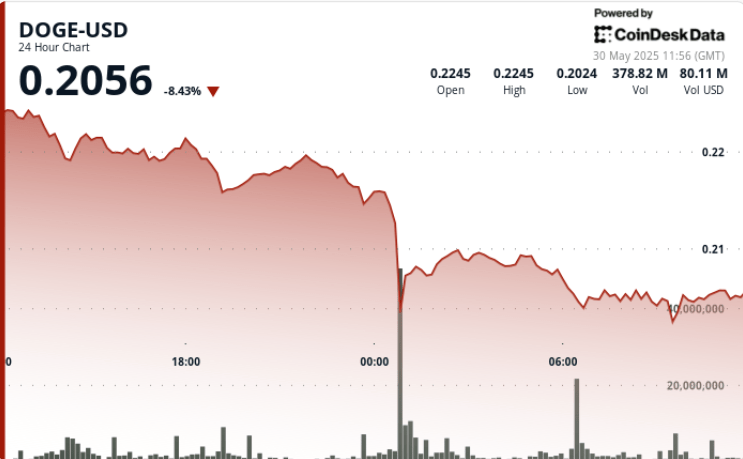

Dogecoin Doge, the cryptocurrency of the popular meme, endured a difficult night when it plunged more than 10% into a sudden sale that rocked the markets.

The decline – from $ 0.226 to $ 0.202 – occurred around midnight, coinciding with a sharp increase in the volume of negotiation to 1.18 billion, highlighting a race of traders reacting to broader market attacks.

While DOGE has achieved a modest rebound in its stockings, it remains stuck in a consolidation model between $ 0.202 and $ 0.206. This suggests that the market takes a break after the initial shock, but traders remain cautious, volatility narrowing and no decisive direction emerging.

Technical analysis shows that DOGE tests several levels of support during the crash before establishing a key resistance at $ 0.217. A double-bottom potential pattern may be forming, giving a little hope to the bulls looking at an $ 0.25 if Doge can take enough momentum to exceed this resistance.

The interest open in Doge derivatives has climbed 2.89% to 2.71 billion dollars, which indicates that traders are positioning themselves for the next major decision. Whether this decision is increasing or down is always an open question, because the mixed feeling prevails through the market.

Technical analysis

- DOGE went from $ 0.226 to $ 0.202, a sharp drop of 10.6%.

- The most intense sale occurred at midnight (00:00), with a 5.5% dive on an exceptional volume.

- The resistance of the keys was formed at $ 0.217, with broken support levels below.

- Consolidation between $ 0.202 and $ 0.206 Signals Market Indecision.

- A brief recovery between 09:43 and 09:56 saw DOGE go back to $ 0.205, but at low volume.

- The growth of open interests points to merchants who are preparing for a peak of potential volatility.

While dust sets in, traders and investors will closely monitor the signs of a sustained rebound – or a deeper drop – in the coming hours.