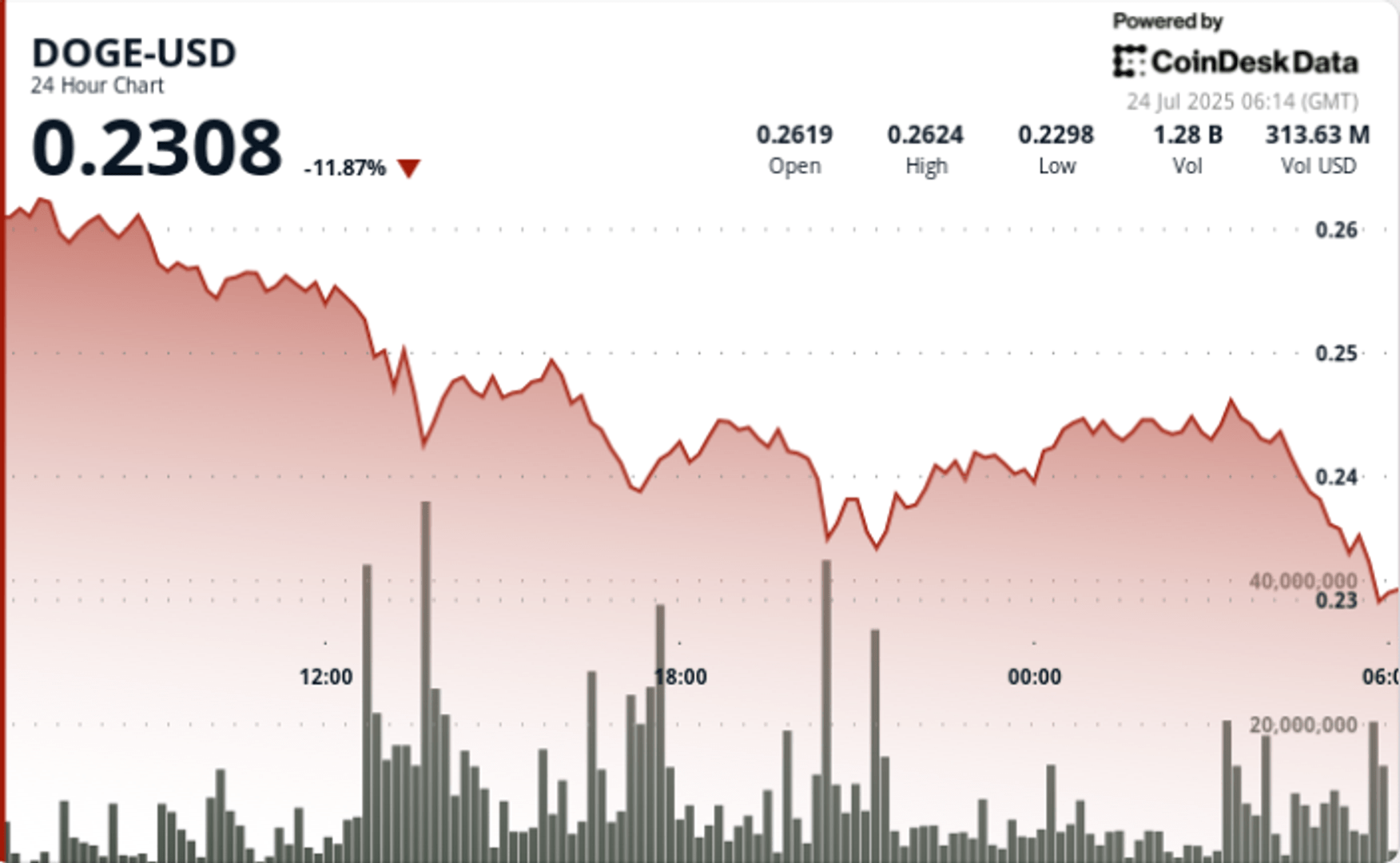

Dogecoin posted a sharp decline during the negotiation session from July 23 to 24, spending 11% from $ 0.26 to $ 0.24 in the midst of sustained institutional sales pressure and extreme volatility.

Negotiation volumes exceeded 2.26 billion tokens during the sales window, marking one of the highest peaks of activity in recent weeks. Analysts have cited a broader fragility of the cryptography market and the benefit of major holders as key engines of the decision.

Despite a brief rebound on the level of $ 0.23, DOGE failed to recover the resistance at $ 0.25, closing the nearby session stockings and increasing the risk of continuous pressure downwards.

What to know

• DOGE dropped from 11% from $ 0.26 to $ 0.24 during the 24 -hour session ending on July 24 at 05:00 GMT

• intra -day fork of $ 0.032 marked with 12.06% volatility, driven by intense sales pressure

• Concentrated sales sales for 13: 00 to 17: 00 GMT while DOGE rejected $ 0.25 on 2.26b + volume

• The last hour experienced an additional decrease of 1.45% from $ 0.24 to $ 0.24, confirming continuous weakness

• Support temporarily trained at $ 0.23 but failed to stimulate sustainable recovery

New context

The feeling of the market remains fragile through altcoins as macroeconomic concerns – in particular around global trade tensions and the tone of the bellicist policy – the risk of exacerbates.

DOGE saw brief upward speculations after the announcement of the original treasure at the beginning of the month, but Momentum quickly faded while institutional players began to relax the positions.

Analysts note technical exhaustion and the distribution of trend support as triggers for the last step.

Summary of price action

DOGE exchanged in an intra -day range of 12% from $ 0.26 to $ 0.24. Most of the withdrawal occurred between 1:00 p.m. and 5:00 p.m. GMT on July 23, with several rejection wicks at $ 0.25 accompanied by high sales volumes. Critical ventilation followed in the time of final negotiation between 04:48 and 05:47 GMT, because the token fell 1.45% additional on a net volume peak exceeding 30 million tokens between 05: 04–05: 07. The price temporarily rebounded at $ 0.23 but could not recover the resistance.

Technical analysis

• According to the Technical Analysis Model of Coindesk Research, $ 0.25 was established as a firm resistance to the continuation of multiple rejection candles in large volume.

• The last hour showed abrupt rejection from $ 0.24 to $ 0.24 with high liquidation activity

• $ 0.23 is now the key support to monitor; The violation could extend to $ 0.21

• The hourly RSI remains in territory occurring but lack of confirmation of upward divergence

• The volume profile suggests institutional outputs rather than detail panic

What traders look at

Traders closely monitor Doge’s behavior around the $ 0.23 level as a key pivot for short -term direction.

A failure to be held could open around $ 0.21, while the recovery of $ 0.25 on the volume can suggest an inversion potential. Volatility remains high and whale activity should continue to drive intraday oscillations.