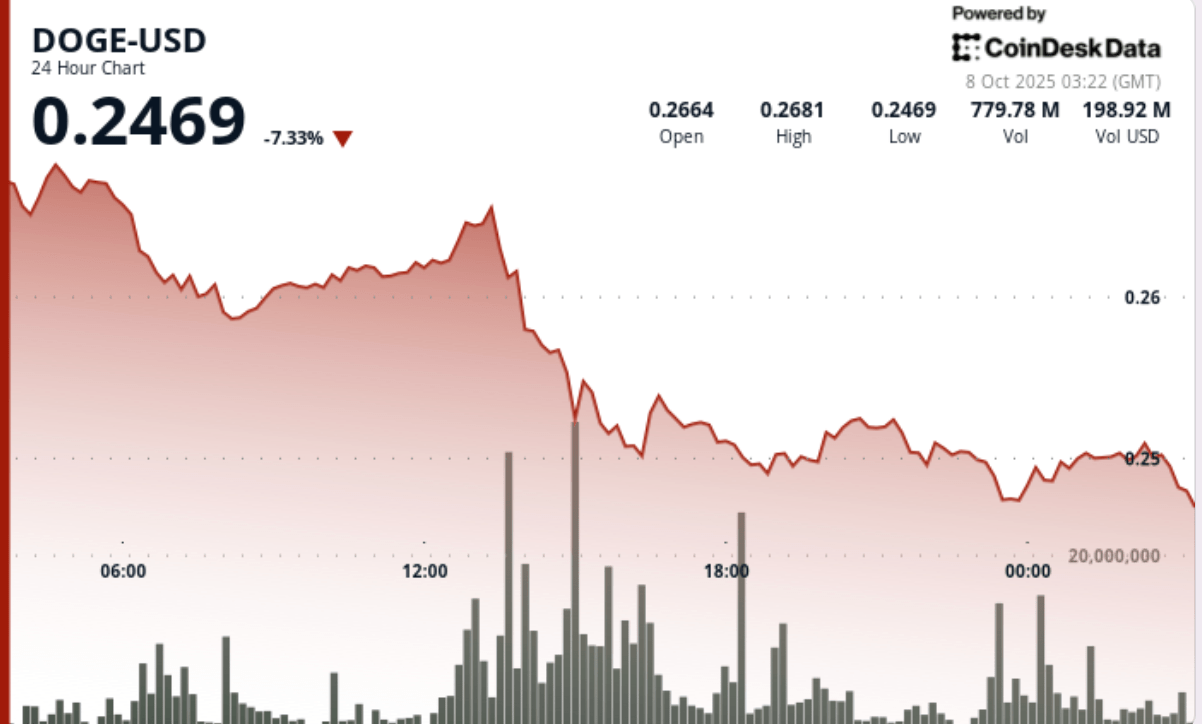

Dogecoin fell 8% during Tuesday trading as whales landed at $0.27 resistance before rallying back to near $0.25. A billion-token liquidation wave marked the day’s low, but late-session releases showed smart money pulling back, hinting at a possible base.

News context

- Heading macroeconomic factors remain at the heart of the picture. Traders assess the likelihood of global monetary easing by the end of the year at almost 98%, a context that has fueled volatility in currencies and cryptocurrencies. Meme coins like DOGE tend to trade as high-beta liquidity plays, meaning they can swing harder in either direction when global conditions change.

- Structurally, ETF filings from companies like Grayscale and Bitwise keep DOGE in the conversation on broader institutional flows, even though the immediate focus has been on bitcoin and ether. This narrative gives the DOGE liquidity profile a longer tail than retail hype alone.

- Mining investments gradually expanded through 2025, supporting accumulation trends among whales. Infrastructure flows are important because they support supply distribution, and the continued influx of capital into DOGE mining demonstrates confidence in the long-term viability of the asset.

Price Action Summary

- Resistance at $0.27 was strengthened after heavy volume of 632.9 million was rejected, setting a clear ceiling for traders to watch.

- The steepest drop occurred during the 1:00 p.m. to 3:00 p.m. UTC window, when DOGE fell 5% in just two hours as over a billion tokens exchanged hands.

- Support at $0.25 proved resilient. This level triggered both whale accumulation and short covering, preventing a deeper fall into the $0.24 range.

- Over the last 60 minutes of trading, DOGE has rebounded about 1% from its lows, breaking intraday resistance levels around $0.25 on steady prints of 30 million DOGE at a time. A double bottom pattern between 11:49 p.m. and 12:00 a.m. reinforced the idea of a technical base.

- The 24-hour trading range extended to $0.144, or about 4.8%, making it one of the widest sessions in recent weeks and highlighting the fragility of order books.

Technical view

- Resistance: $0.27 remains the immediate ceiling after repeated failures; sustained closes above would be necessary to reverse the upward trend bias.

- Support: $0.25 is the key structural floor for now, defended by the whales; if breached, the next downside target lies near $0.24.

- Volume: Daily averages of around 500 million were eclipsed by spikes in liquidations topping 1 billion, signaling institutional distribution pressure at an all-time high.

- Model: The symmetrical triangle structure indicates a breakout range of $0.30 to $0.47 once the momentum resolves.

- Momentum: The late session rebound confirms the short-term accumulation, but the overall trend remains capped below $0.27.

What traders are watching

- Whether $0.25 continues to serve as structural support or gives way to a deeper test at $0.24.

- Whether the whale accumulation of 30 million DOGE marks the bottom of the cycle or represents an opportunistic entry ahead of further volatility.

- How Pending SEC Rulings on DOGE-Linked ETF Filings Shape Liquidity and Institutional Positioning.

- Macroeconomic factors: The balance between easing bets and renewed inflation risks, and their impact on risk appetite for high-beta tokens like DOGE.

- The breakout triggers from the current symmetrical triangle pattern – whether DOGE can quickly reclaim $0.30 or continues to stall below resistance.