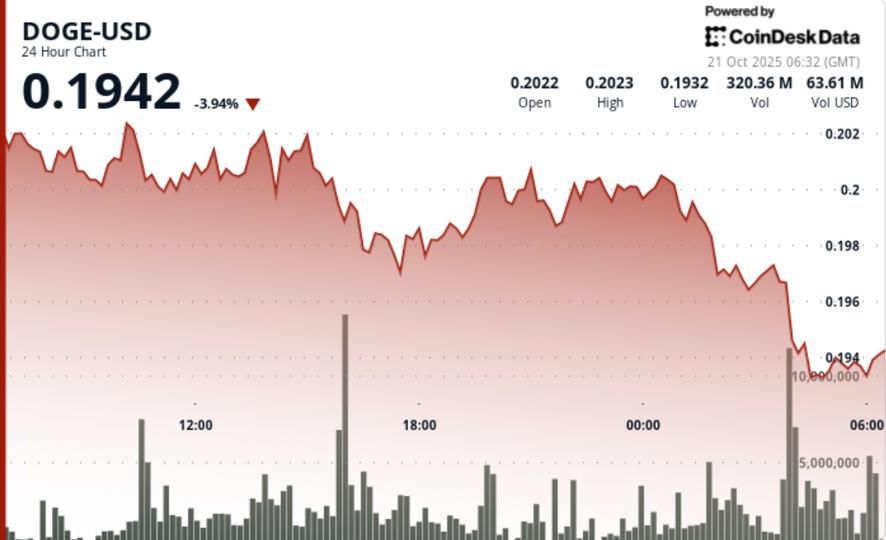

Dogecoin traded heavily over the weekend, falling 3% as institutional desks sold off risks between the majors. Selling built resistance near $0.20 after several failed breakout attempts, while macroeconomic stress keeps traders on the defensive in alternative markets.

News context

DOGE’s retracement follows a week of volatile cross-asset flows triggered by new headlines over US-China tariffs. Institutional sentiment has shifted away from risk as macro funds reduced crypto exposure alongside a broader deleveraging of altcoin futures. Regulatory overhang due to pending US Treasury rules adds pressure as corporate treasuries reduce their crypto allocations.

Price Action Summary

DOGE traded between $0.204 and $0.197 from October 20-21, marking a 3% range with heavy afternoon volume. The 3:00 p.m. UTC block saw 818 million DOGE change hands – nearly three times the daily average – as big sellers capped rallies above $0.20. The price slipped towards $0.197 in late US trading before finding limited support due to low volume.

The last hour (01:10-02:09 UTC) saw an additional 1% decline, with algorithmic triggers triggered below $0.20. Volume reached 40.5 million at 01:56, confirming programmatic liquidation before markets stabilized near $0.197.

Technical analysis

The structure remains bearish in the short term while DOGE remains below the $0.20 mark. Repeated rejections at this level mark a clear resistance band, with the next support around $0.194 to $0.196. The RSI and momentum indicators remain negative but close to oversold; traders note potential squeeze risk on any recovery above $0.201.

What traders are watching

Desks are watching for signs of stabilization near the $0.195 support. A net recovery of $0.201 on volume could trigger short-term covering between $0.208 and $0.21. Failure to defend $0.194 exposes $0.187 – last month’s structural base. Macroeconomic sentiment always determines which direction to take; any easing of trade war rhetoric could trigger a risk rebound led by DOGE and SHIB.