Dogecoin lost a critical technical level after a massive sell-off, signaling a change in near-term market structure and forcing traders to reassess near-term risk.

News context

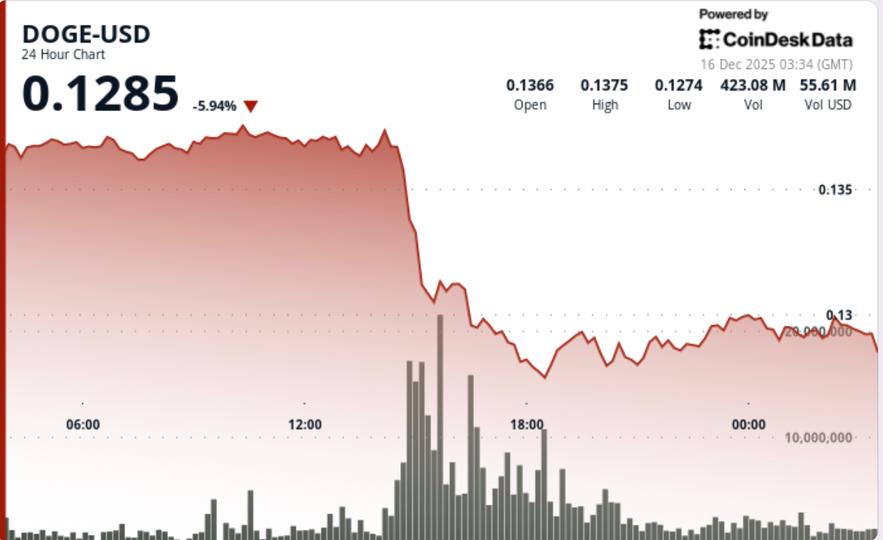

- Dogecoin fell 5.5% over the past 24 hours from $0.1367 to $0.1291 as selling pressure intensified in the broader crypto market.

- The move came amid lower risk sentiment and declining participation in higher beta assets, with meme tokens absorbing outsized declines relative to the majors.

- Although no single catalyst caused this wave of selling, this decision coincided with the continued withdrawal of speculative exposures and a tightening of liquidity conditions.

- DOGE remains range-bound over a longer time frame, but the latest decline represents a clear failure to defend levels that held during the recent consolidation.

Technical analysis

- The break below $0.1370 marked a decisive loss of near-term trend support. Volume jumped to 1.63 billion tokens during the sale, approximately 267% above average, confirming that the move was due to strong flows rather than passive drift.

- Price clearly broke intermediate supports without a significant break, indicating limited supply depth once $0.1320 gave way. Failure to reclaim $0.1300 during the first rebound attempt keeps the short-term structure trending lower, even as momentum indicators begin to stabilize.

- From a structural perspective, DOGE has moved from range compression to downward expansion. Until prices regain their former support, rallies remain corrective rather than trend-changing.

Price Action Summary

- After hitting a session low near $0.1290, DOGE began to stabilize as selling pressure subsided. Subsequent candles showed reduced volume and shorter downside extensions, suggesting that liquidation pressure may be easing.

- Intraday price action has started to form higher lows from the $0.1290 base, but upside tracking remains limited. Sellers continue to appear near $0.1300, keeping the price capped and confirming this level as immediate resistance.

What Traders Need to Know

- Near-term direction now depends on whether DOGE can sustain above the $0.1290 to $0.1280 area.

- Sustained acceptance below this zone would expose the next support band near $0.1250, while a successful recovery of $0.1300 would be the first signal of a slowdown in bearish momentum.

- The volume behavior is essential. Continued normalization would favor a consolidation phase, while further spikes in downward movements would suggest greater distribution. For now, DOGE is in a fragile stabilization phase, where patience and confirmation matter more than anticipation.