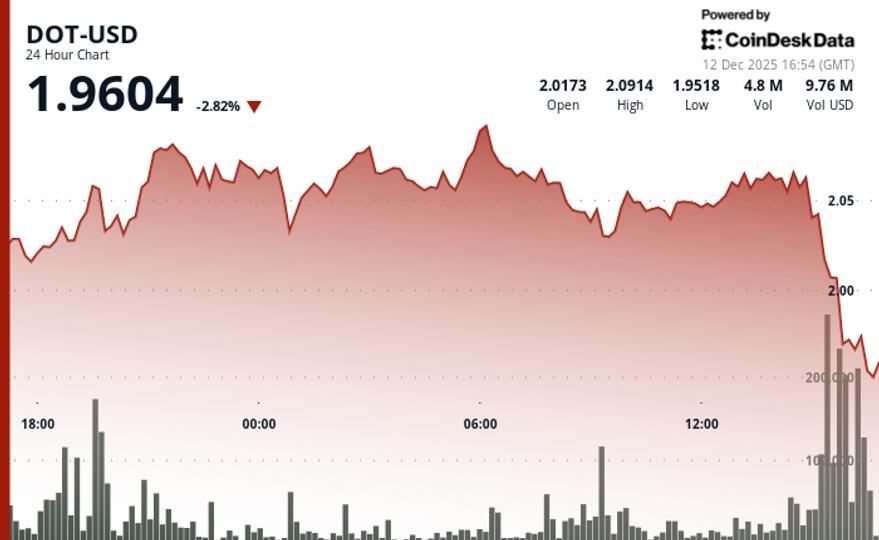

suffered a technical breakdown during Friday’s session as the token plunged from a high of $2.09 to $1.97, erasing its previous rally momentum.

The decline occurred on heavy volume that reached 284% above normal levels, according to CoinDesk Research’s technical analysis model.

The model showed that the token broke support at $2.05 as selling pressure intensified throughout the period.

The breakdown accelerated on a volume of 10.3 million tokens, confirming the violation of the ascending trendline support that anchored the recent bullish structure, according to the model.

Multiple tests of the $2.05 level established this area as key resistance before the collapse undermined the technical foundations.

Price action revealed a violent rejection of higher levels as DOT forms an ascending channel from $2.01 to $2.09 before encountering heavy selling, according to the model.

Broader crypto markets also fell, with the CoinDesk 20 index down 0.6% at press time.

Technical analysis:

- Main support holds psychological level of $1.95 after breakdown to $2.05

- Immediate resistance forms at $1.985 following failed recovery attempts

- Critical ascending trendline support violated during breakdown

- Exceptional volume of 10.3 million marks a 284% increase above the 24-hour average

- The peak hourly volume of 995,000 represents 400% above the session benchmark.

- High volume confirms technical failure rather than questioning validity

- Ascending channel from $2.01 to $2.09 ends with violent rejection

- Consolidation range of $1.95 to $2.01 contains current price action

- Downside target approaches $1.90 if $1.95 support fails to hold

- Recovery requires reclaiming $2.00 resistance with volume confirmation

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.