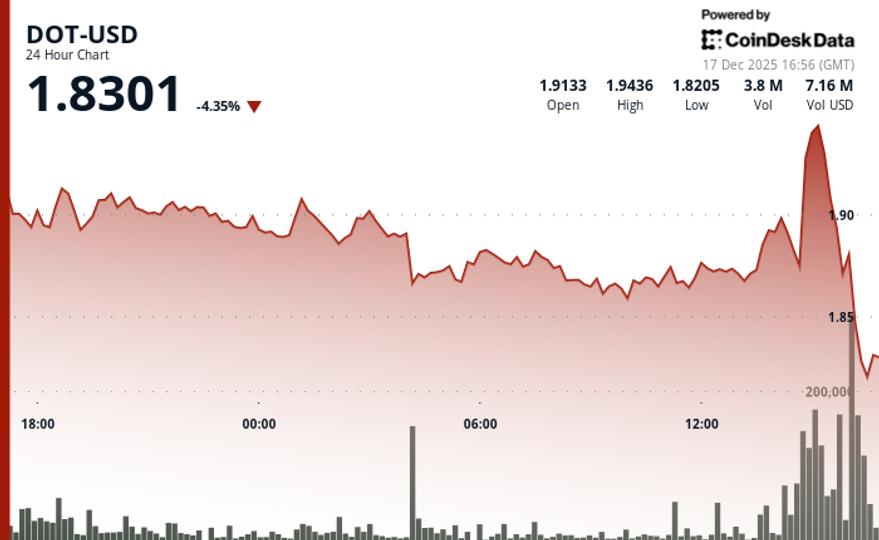

collapsed through critical support on Wednesday, falling 3% to $1.83 as technical selling overwhelmed bullish news from USDC integration.

DOT decisively broke the psychological floor of $1.90 despite Coinbase (COIN) announcing direct support from the Polkadot network.

According to CoinDesk Research’s technical analysis model, a strong distribution emerged over the last two hours of trading, as the token crashed from $1.93 to $1.82 and stop-losses spread through multiple support zones.

The model showed that volume reached 9.47 million tokens, 340% above the 24-hour average.

This rise confirmed the institutional distribution at the $1.95 level, according to the model.

The breakout established clear bearish momentum with highs below the $1.92 high, according to the model.

Broader crypto markets also fell. The CoinDesk 20 Index was down 2% at press time.

Technical analysis:

- Main support established at $1.82 demand zone after failure of psychological $1.90 level

- Resistance now lies at the broken $1.90 level, with a secondary barrier at the $1.95 rejection point.

- Outage volume at 340% of average institutional distribution confirmed over 24 hours

- Descending channel formed from $1.92 high to break of $1.90 support

- The structure of lower highs has established a medium-term bearish bias

- Failed breakout above $1.95 created risk of double top formation

- Immediate resistance at $1.90 should act as support for any recovery attempt

- Downside risk extends towards the $1.75-1.80 area if current support fails

- A recovery above $1.95 is needed to negate the bearish technical structure and resume the uptrend

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.