XRP fell sharply after failing to maintain the momentum over the resistance area from $ 2.88 to $ 2.89, even if ETF speculation continues to build before the dry October deadlines.

The sale highlights a pivotal inflection point while institutional flows are fighting against long -term consolidation models which, according to many analysts, could precede a more important decision.

New context

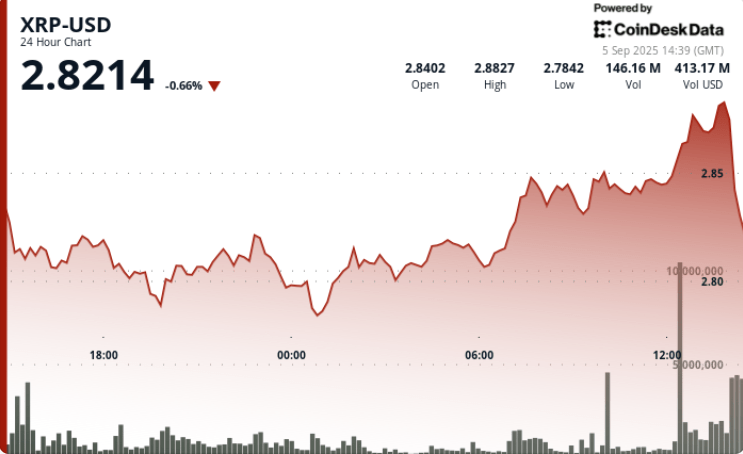

• XRP fell 4% from $ 2.88 to $ 2.84 on September 5 after reaching an intra -day summit of $ 2.89, as the institutional sales pressure emerged.

• The volume of negotiation exploded to 227.75 million during the 12:00 p.m., almost 4x the average 24 hours a day of 58.40 million.

• Six asset managers, including Grayscale and Bitwise, made a request for FNB XRP Spot, with dry decisions expected in October.

• Ripple’s legal regulations with the SEC has improved regulatory clarity, increasing industry estimates to a probability of 87% FNB approval.

• Technical strategists compare the 47 -day current consolidation beach to the 2017 XRP structure, which preceded a parabolic rally.

Summary of price action

• XRP exchanged a fork of $ 0.10 (3.47%) Between $ 2.78 and $ 2.89 during the 24 -hour session from September 4 from September 3 to 5, 2:00 p.m.

• The asset went from $ 2.84 to $ 2.89 over a massive volume at 12:00 p.m. and 1:00 p.m. before rejecting the resistance.

• A concentrated movement of 60 minutes from 1:26 p.m. to 2:25 pm saw a slide of $ 2.88 to $ 2.88 to $ 2.84 over a volume of 10.6 million, vioder intraday media at $ 2.86 and $ 2.85.

• XRP closed the session at $ 2.84, just above primary support levels close to $ 2.77.

Technical analysis

• Resistance: $ 2.88 to $ 2.89 validated area after several cooked eruptions.

• Support: Immediate levels from $ 2.84 to $ 2.85, with stronger support at $ 2.77.

• Model: 47 -day consolidation suggests a potential breakdown configuration; $ 4.63 to $ 13 Targets reported if the structure solves.

• Momentum: RSI in the mid -1950s, showing a neutral bias; MacD histogram converging on a bullish crossing.

• Volume: 227.75 m to a PIC VS 58.40 m Middle confirms the institutional distribution.

What traders look at

• If $ 2.77 is decisive support in September.

• Rensées ETF SPOT XRP of sec – considered as a potential bullish trigger.

• Continuation of the accumulation of whales (Tokens of 340 meters recently added) Despite the short -term distribution pressure.

• Signs of slowdown above $ 3.30, which, analysts, could open tracks around $ 4 +.