The Securities and Exchange Commission (SEC) is not yet ready to make a decision on two critical characteristics that the transmitters of the funds (ETF) negotiated in exchange for crypto (ETF) hope to add to their products.

The regulator delayed a decision on the question of whether it will allow buyouts in kind for the Bitcoin Fund from Wisdomtree (BTCW) and Bitcoin Fund (BitB) by Vaneck and Ethereum Fund (ETHW) on Monday. He also moved his deadline for a decision concerning a proposal from Grayscale to make it possible to mark his Ethereum Trust (ETHE) and Mini Ethereum Trust (ETH), that the exchange of the asset manager, Nyse Arca, had asked in February.

CBOE, the exchange which is associated with five of the other issuers of an ETHER ETHER, including Fidelity, Franklin Templeton, Vaneck and Invesco / Galaxy, submitted his file modified in March for the Fidelity Ethereum Fund (Feth) and the Franklin ETF ETF (Ezet).

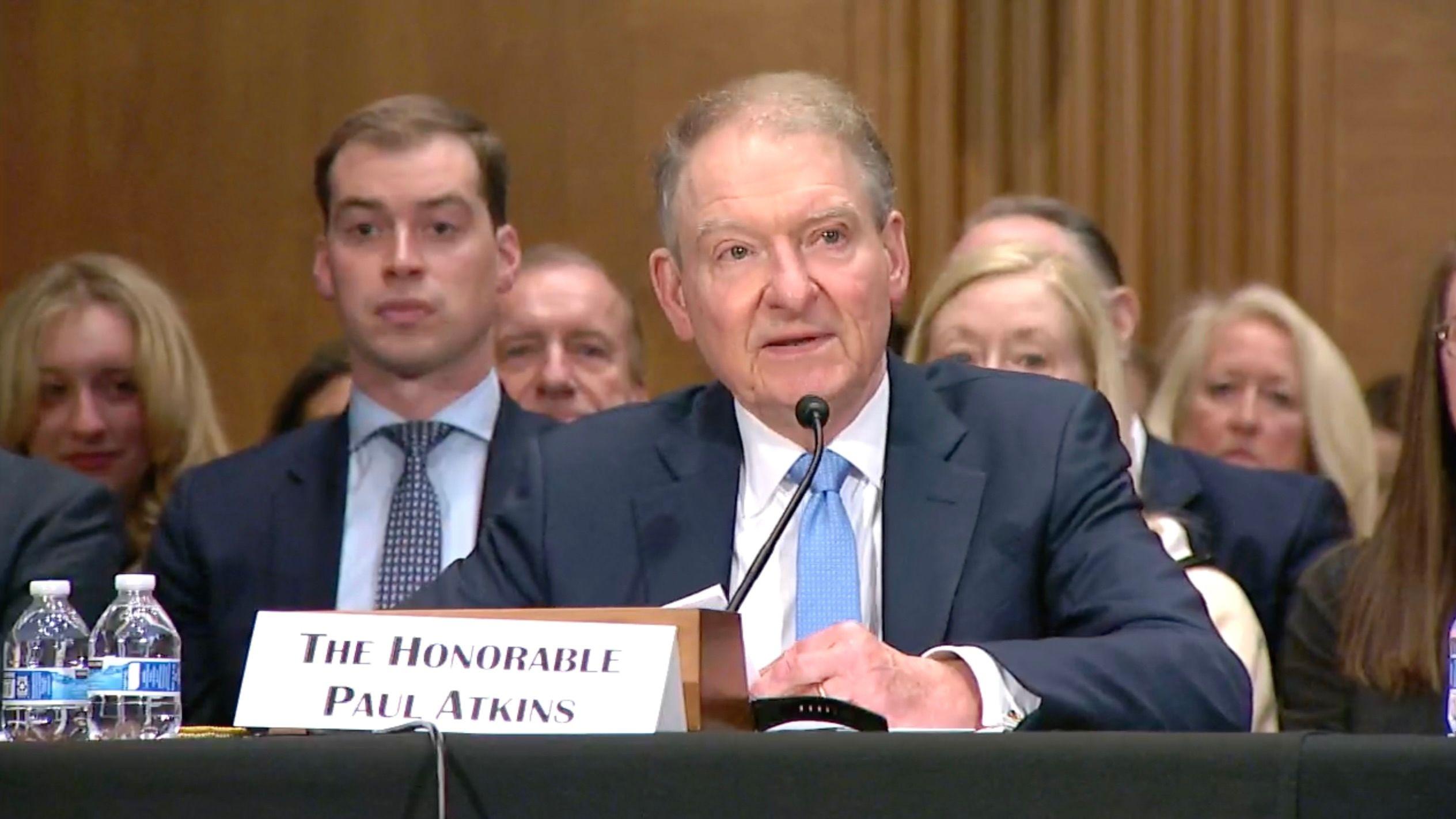

The dry did not allow us to mark before in the ETHE of the Spot ether. But with the appointment of the new President of the SEC, Paul Atkins, who was confirmed by the Senate last week, things could change quickly.

Several other jurisdictions, including Hong Kong, Canada and Europe, already have an expert in green for ETFs, but that does not put much pressure on the dry, said an expert.

“The dry will take its time and move as quickly or as slow as they wish,” said James Seyffart, ETF analyst at Bloomberg Intelligence. “They do not care what other regulators do according to my experience, they could learn from them, but I do not think that a regulator will approve something will blow up the dry through hoops and catch up. They will go to their own pace.”

The regulator now has until June 3 to make a decision on redemptions in kind on Bitwise and Wisdomtree products and on June 1 to decide on the proposal for Graycale.