Ether (Eth) Jumped at $ 4,200 on Binance early Saturday, its highest since December 2021, after a two -day rally fed by heavy exchanges and $ 207 million in short liquidation.

This decision followed the break on Friday above $ 4,000 for the first time since December 2024, a technical stage which attracted fresh purchases and prepared the land for the push on Saturday.

Miles Deutscher said these forced acquisitions helped to speed up the rally. In a previous article, he described a “wealth effect in chain”: as the price of the ETH increases, major holders and retail investors see their positions become profitable, which encourages them to reassign the capital in smaller and higher risk in search of larger gains. This dynamic, he said, can amplify the rallies beyond the ETH itself.

Deutscher also mapped a three-step market rotation that he is waiting for months to take place: an Altcoin mini-season led by ETH, a rotation in Bitcoin which could go up the BTC to $ 120,000 to $ 140,000 while altcoins are lagging behind, and finally a passage to ETH and smaller tokens for a “explosion” potential.

Crypto analyst Michaël Van de Poppe called on Saturday $ 4,200 thrust a “wild movement” and warned that purchasing at such high levels included a higher risk. Although he sees the ETH organizing himself for an escape to heights of all time, he argued that the capital allowance to projects within the ETH ecosystem could provide better percentage yields if the momentum continues. He also declared earlier that the strength of the ETH continues could open the way for substantial gains in altcoins, potentially enriching portfolios positioned for a wider rotation of the market.

The Intelligence Platform of the Santiment Market noted that the rise of ETH above $ 4,000 on August 8 was the first since December 16, 2024 and came with a strong increase in the bullish language of retail traders. Mentions of terms like “buy” and “bullish” have roughly doubled compared to “sale” and “lower”. The company has warned that excessive confidence can sometimes cause short -lived breaks even during high asumentation trends.

Strengths of technical analysis

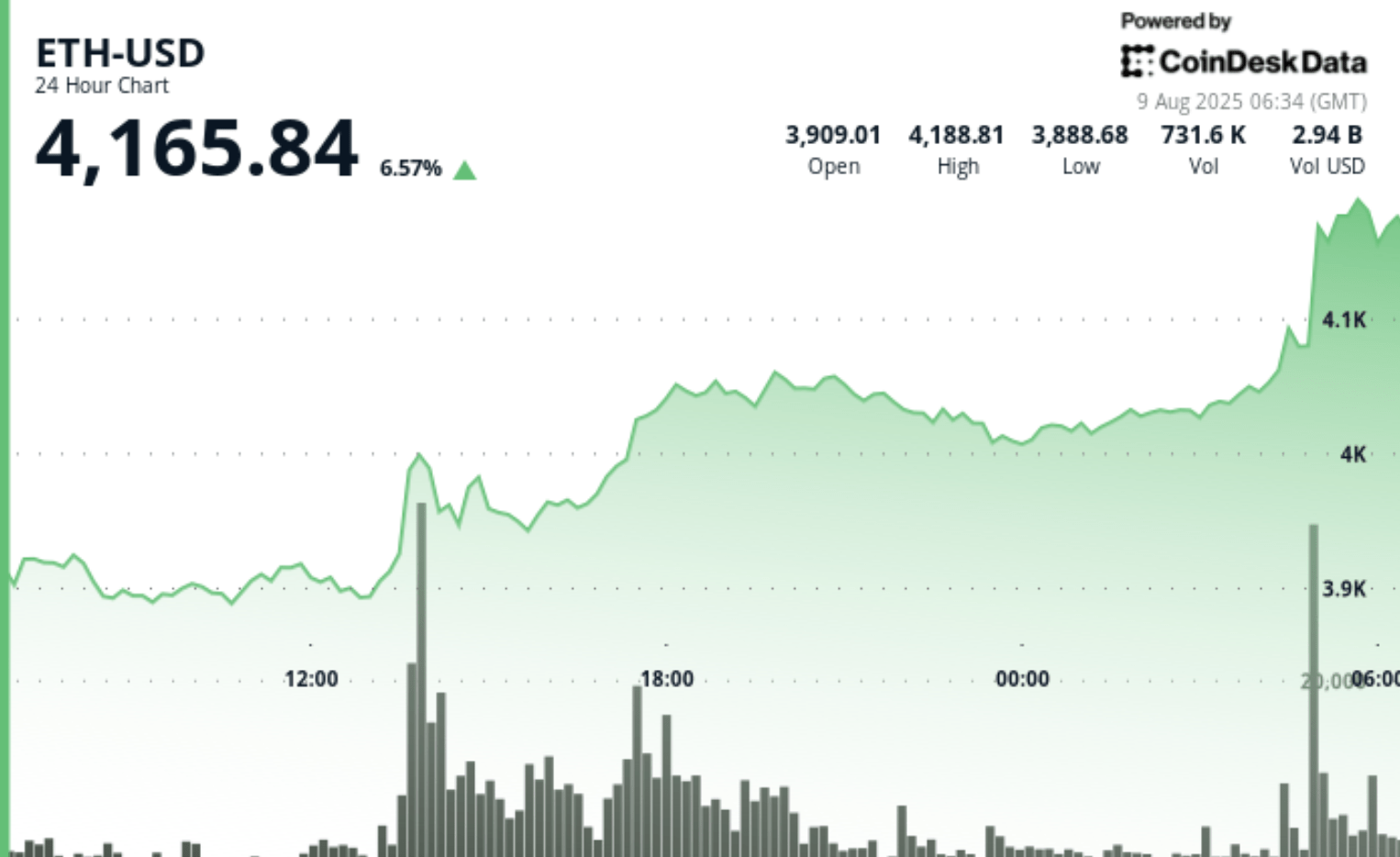

- According to the Technical Analysis model of Coindesk Research, between August 8 at 07:00 UTC and August 9 at 06:00 UTC, ETH increased from $ 3,914.59 to $ 4,160.29, a gain of 6%, negotiating between $ 3,885.03 and $ 4194.53.

- The first escape occurred at 1:00 p.m. UTC on August 8, pushing prices over $ 4,000 out of 646,459 ETH in volume, almost triple the average of 24 hours of 218,847 ETH.

- A second push at 5:00 am UTC on August 9 increased prices at the session peak of $ 4194.53 out of 714,461 ETH in volume, once again than triple the daily average.

- In the last hour (August 9, 05: 19-06: 18 UTC)ETH went from $ 4,157.33 to $ 4194.53 before retiring at $ 4,158.50, with $ 42.52 in intraday fluctuations.

- The purchase has briefly pushed prices over $ 4,190 before taking advantage, establishing support between $ 4,155 and $ 4,160, suggesting consolidation as larger players locked up in gains near the psychological level of $ 4,200.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.