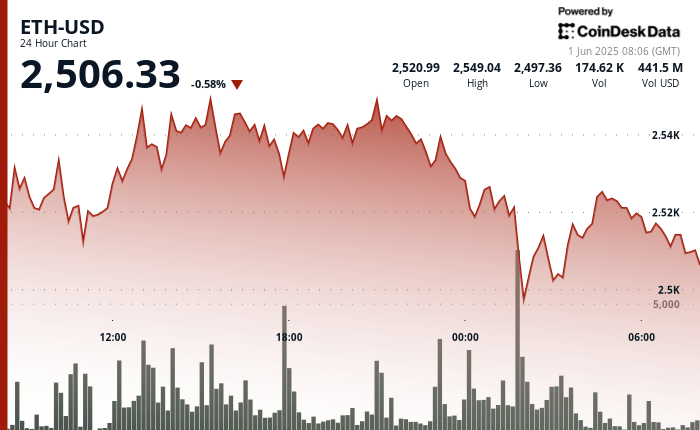

Ethereum (ETH) faced a late drop pressure in late, passing below the level of $ 2,500, the sales volume jumped and a wider feeling of risk has weakened. Global trade tensions and renewed American tariff risks have triggered risk flows, digital assets increasingly reflecting traditional markets in their reaction to geopolitical uncertainty.

Chain data revealed significant entries to centralized exchanges – notably 385,000 ETH at La Binance – a reduction in speculation that institutional actors can cut the positions. Although the ETH has since been modestly given to the exchange of around $ 2,506, market observers are looking closely, that buyers can defend this level or if another lower leg is imminent.

Strengths of technical analysis

- ETH exchanged in a volatile range of $ 48.61 (1.95%) between $ 2,551.09 and $ 2,499.09.

- The price action has formed a bullish upward channel before breaking down in the last hour.

- The heavy sale emerged almost $ 2,550, with speeds accelerating in a lively reversal.

- ETH went from $ 2,521.35 to $ 2,499.09 between 01:53 and 01:54, a combined volume exceeding 48,000 ETH in two minutes.

- The volume was normalized shortly after, and the price recovered slightly, consolidating around the band from $ 2,504 to $ 2,508.

- The level of $ 2,500 is now acting as an interim support, although Momentum remains fragile with signs of distribution still obvious in recent volume models.

External references