Ether (ETH)

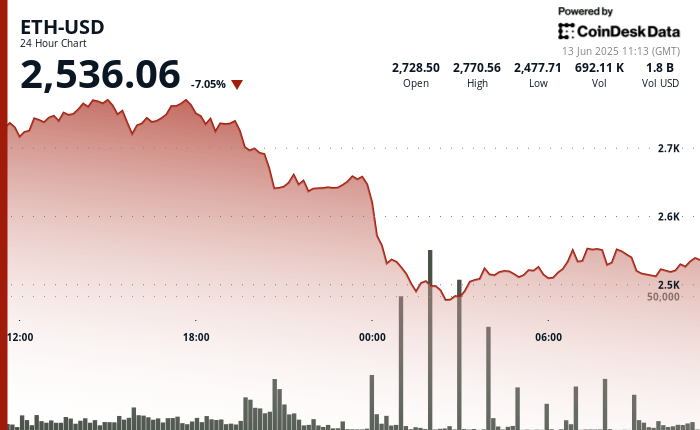

dropped more than 7% in the last 24 hours, going from a maximum session of $ 2,770.56 to as low as $ 2,477.71 before recovering slightly at $ 2,536 at the time of the press.

The sharp decline occurred in the middle of a large risk element in global markets after Israeli air strikes on Iranian military infrastructure – a major escalation in the tensions of the Middle East who took investors off guard.

According to a CNBC report, Israeli Prime Minister Benjamin Netanyahu said the strikes were part of a “targeted military operation” against Iran’s nuclear and missile programs. Iran responded by launching around 100 drones to Israel in retaliation. While the United States has denied direct participation, Secretary of State Marco Rubio stressed that America’s priority protected its regional forces.

In response to increasing geopolitical risk, investors have fled in traditional security assets. The US dollar joined 0.6% on Friday morning, reversing a hollow of three years compared to the day before. Gold also increased to almost a two -month summit, while oil contracts increased up to 13% before implementation gains. The strength of the dollar was particularly notable because it has surpassed other currencies with a security heap like the Swiss franc and the Japanese yen.

Market strategists have noted that the depth and duration of the conflict – in particular its impact on oil – would shape the behavior of investors in the future. Analysts said the dollar rebound was significant, even if it is more silent than expected. Meanwhile, the Bank of America’s survey has shown that traders have remained shortly short the dollar, although the conviction of this trade has not yet collapsed.

A clear movement of ETH is lower, aligned with a similar weakness on the risk scale observed through stocks, bonds and basic products. While prices have stabilized above the level of $ 2,530 for the moment, volatility will remain likely to remain high as the traders digest the geopolitical situation which takes place.

Strengths of technical analysis

- The ETH went from $ 2,770.56 to a hollow of $ 2,477.71 – an intraday drop of 10.6%.

- The volume increased to 692,000 ETH because the sale intensified during American evening hours.

- The price has briefly bouncing in the $ 2,480 area but faced a resistance less than $ 2,550 t.

- The latest flash movement formed a tight consolidation strip between $ 2,530 and $ 2,540.

- The decreased volume gradually suggests short -term exhaustion but no confirmed reversal.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.