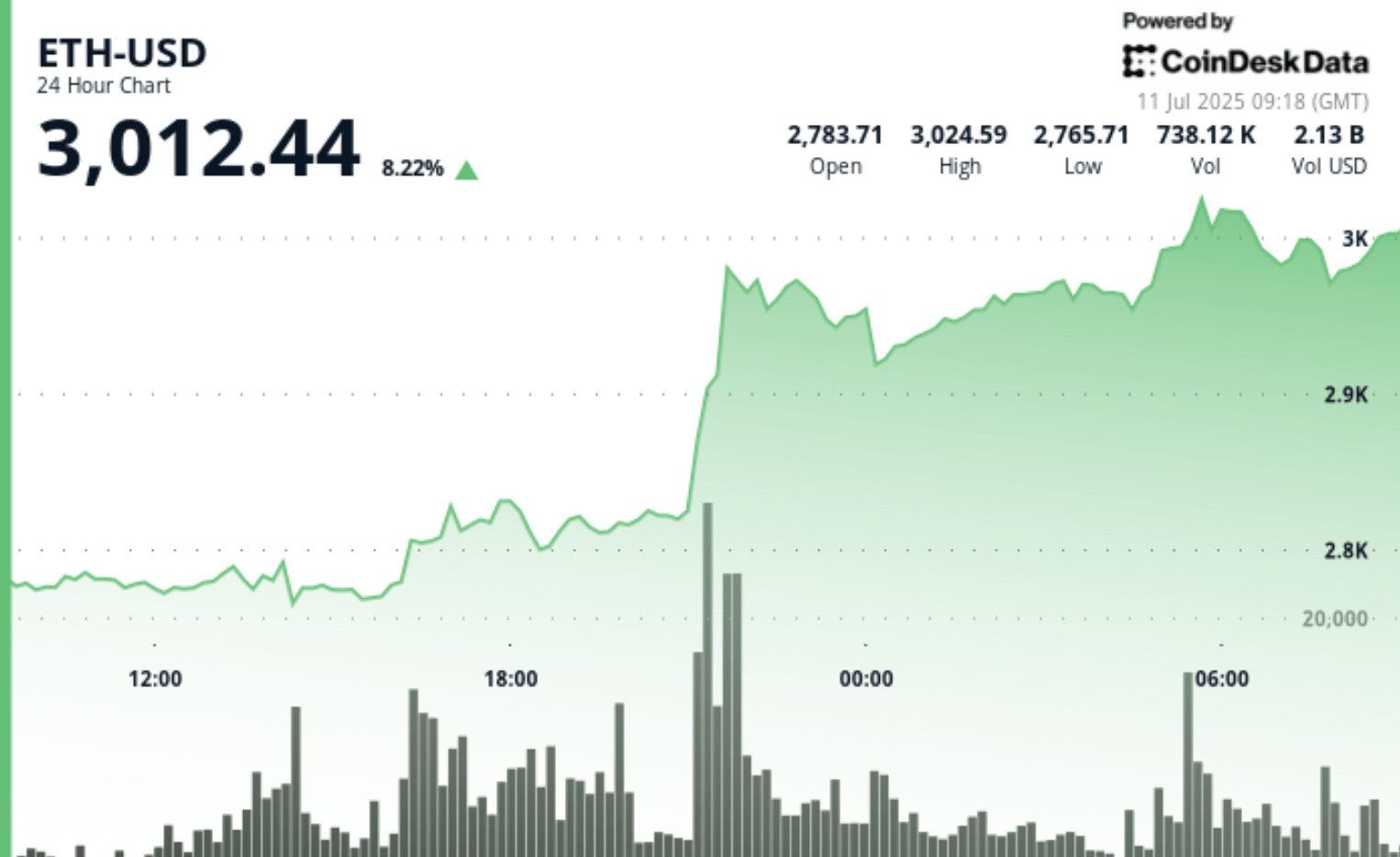

At the time of writing the present (Eth) was negotiated at $ 3,012, up 8.22% during the last 24 -hour period, according to the Technical Analysis model of Coindesk Research. The wider market of cryptography, with regard to the Coindesk 20 index increased by 6.39% in the same period.

In a recently published research article entitled “Blockchains as emerging economies”, the third largest asset manager in the world explained how “ether can serve as a means of exchange and reserve of value”.

In addition, in a blog post published Thursday, the Etheruem Foundation announced its intention to integrate zero knowledge (ZK) Tuesdays throughout the Ethereum battery, starting with a layer zkevm. Originally, validators will be able to choose customers who check several proofs of execution outside the chain of different ZKVM, rather than re -execute blocks. This configuration uses the existing customer diversity model of Ethereum for additional security, with a minimum of protocol modifications necessary to take charge of the pipeline execution in the next Glamsterdam upgrade.

Although the adoption of ZK customers will start small, it should grow as confidence is built. When a majority of validators are confident in ZK evidence, Ethereum can increase the gas limit and switch to the verification of the default proof.

To allow this change, the foundation defines the “proving” standards in real time for ZKVM developers. These include latency of 10 seconds for 99% of blocks, open -source code, minimum 128 -bit security, evidence of less than 300 KIB without configuration of confidence and material limits of $ 100,000 in cost and 10 kW in the event of energy consumption – which makes the house possible.

Although Prouvance in the Cloud is already affordable, the emphasis is placed on optimizing decentralized configurations at home. The Foundation is expecting a continuous innovation towards these objectives to DevConnect Argentina, with ZKVMs which become critical infrastructure for the future of Ethereum.

Finally, yesterday, the Lockchain Analytics Glassnode platform noted a rare event on the derivative market: the term of Ether 24 hours a day has briefly exceeded that of Bitcoin. According to the cabinet, ETH Futures marked $ 62.1 billion in daily volume, ahead of $ 61.7 billion in Bitcoin.

Strengths of technical analysis

- ETH presented an extraordinary bullish momentum in the last 24 hours of July 10 9:00 a.m. to July 110 8:00 a.m., going from $ 2,788.96 to $ 2,976.10, providing a gain of 7.10% with a global range of $ 266.73.

- The most explosive price action materialized at 9:00 p.m. on July 10, where ETH is launched from $ 2,819.79 to $ 2,972.56 on an exceptional volume of 1,202,822 units – almost four times the average of 24 hours of 308,041 units.

- Critical resistance has surfaced at $ 3,027.83 in 05:00 with an increased volume of 529,411 units, while the assets maintained a consolidation greater than $ 2,950.00 throughout the second half of the period.

- Robust high volume support formed approximately $ 2,818.00, which indicates continuous institutional accumulation and an additional potential for dynamics.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.