Ether extended its rally on Monday when institutional demand had jumped and the exchange supply fell to a multi -year hollow.

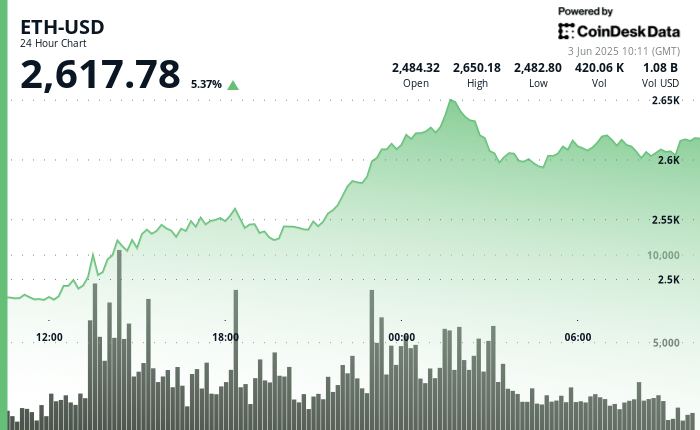

The assets climbed up to $ 2,650.18 before ensuring around $ 2,617, where it is currently negotiated, according to the Technical Analysis Data model for Coindesk Research.

Despite the minor retirement, the ETH remains one of the most efficient tokens this week, supported by $ 321 million in new entries in investment products related to ether. This is the figure in the strongest weekly entrances since December, reflecting the confidence of growing investors in the long -term value of Ether.

Analysts also highlight a drop in the ETH maintained on centralized exchanges, which suggests a change to self-care and accumulation.

Strengths of technical analysis

- ETH recorded a 24 -hour range of $ 172.87 (6.97%), with a peak at $ 2,650.18.

- The key resistance at $ 2,550 was raped with 288,000 ETH in commercial volume.

- The current price action shows a consolidation greater than $ 2,600 after a modest decline.

- The support is about $ 2,610 at $ 2,615, with bulls defending the level of $ 2,600.

- A net volume point at 07:58 (see graph) coincided with a brief drop to $ 2,609.

- The overall trend remains optimistic while the highest stockings continue to hold.