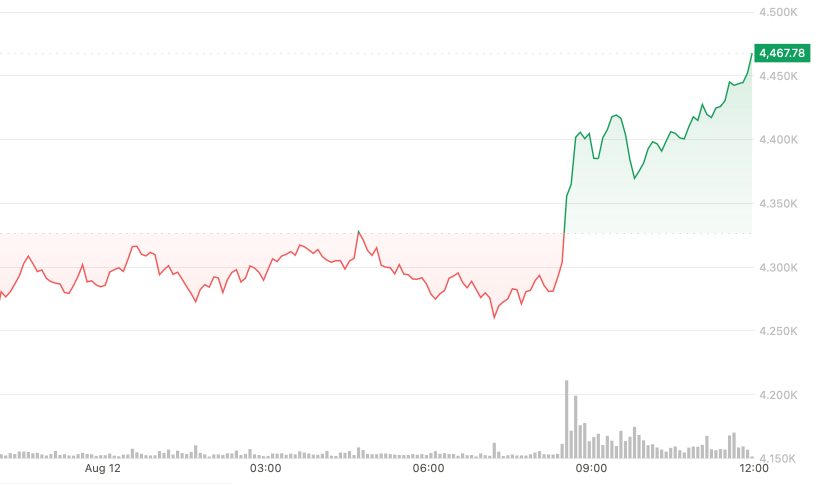

Ether (Eth) has climbed 5% in the last 24 hours to $ 4,470, its highest price since December 2021.

Helping upward action in crypto in general was the report of the consumer price index on Tuesday morning. While the data has been mixed and inflation remains above the 2% objective of the federal reserve, market players raised bets on the interest rates of the American central bank at its next meeting in September.

Improving the ether in particular was a new higher massive leg in the growing movement of the corporate cash strategy. Already the owner of around $ 5 billion in ETH, Bitmine’s immersion technologies from Tom Lee (BMNR) Disclosed plans to collect up to $ 20 billion in capital for other purchases.

This decision extends a rally of several months for the native token of the Ethereum network, which also continues to surpass bitcoin after years of relative weakness. The ETH / BTC ratio increased by more than 0.37 Tuesday, now higher by almost 50% in the last month, but still 15% lower in annual shift.

A key engine in recent weeks has been to increase the negotiated funds in exchange in exchange American. Ether ETF on Monday experienced a record of $ 1 billion in daily admissions, again exceeding their Bitcoin equivalents.

“Ethereum’s outperformance today, with a gain of more than 4% against Bitcoin’s mute movement, reflects the market placed by the market on its own set of powerful catalysts,” said Axel Rudolph, main technical analyst at IG. “Institutional entries in FNB and FNB and FNB after the printing of American ICCs, associated with growing confidence in recent network upgrades, prove to be much more convincing for investors than the wider macro-axis momentum underpinning Bitcoin.”

Supporters have increasingly nicknamed Ethereum “The blockchain of Wall Street”, stressing its central role in tokenizing assets, the accommodation of decentralized financing platforms and food settlement systems that look like a traditional market infrastructure.

“We see a wave of renewed interest in institutional and sophisticated investors who consider ETH as a simple” second “crypto”, said David Siemer, co-founder and CEO of Wave Digital Assets. “They see it as the backbone of Defi, tokenization and the largest intelligent contract ecosystem.”

“Given the backdrop of the background of greater regulatory clarity in the United States and the transition from the Act to Engineering, combined with Digital Treasury Buels from ETH such as Sharplink buying significant quantities of token, and a resurgence of the activity DEFI through the protocols focused on ETH, it is clear that there is a broader institutional interest in The ecosystem, “he said.

If the FED provides that the drop -down traders are betting, the combination of more cowardly monetary policy, high ETF demand and strategic positioning by large investors could further supply ETH race – although, as for previous rallies, volatility can be just as intense in descend.

UPDATE (August 12, 5:53 PM UTC):: Add other comments from David Siemer, co-founder and CEO of Wave Digital Assets.