A net withdrawal in the cryptographic markets sparked nearly $ 735 million in liquidations with bulls bearing the brunt on Tuesday.

ETHER (ETH) and XRP followed the bets in the long term have reserved more important losses than Bitcoin in an unusual decision, indicating the higher interest in Altcoin traders in last week.

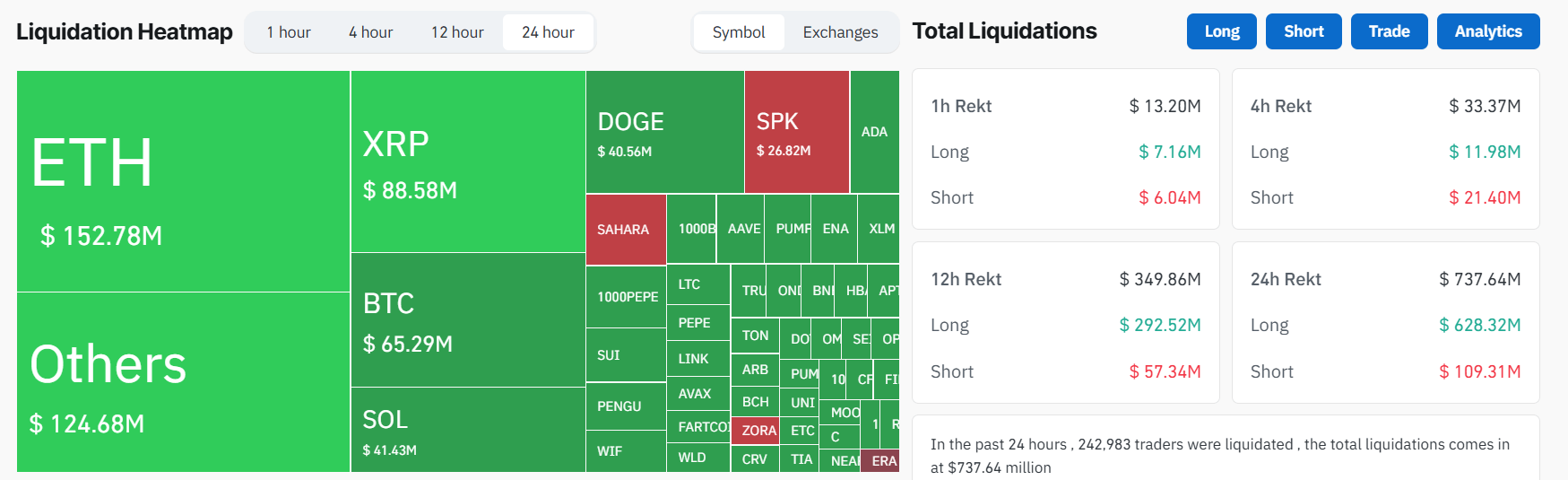

Coinglass data show that ETH traders have lost $ 152.78 million, the largest for any active, followed by $ 88.58 million in Liquidations for XRP. Bitcoin arrived third with $ 65.29 million, despite its larger market capitalization and deeper liquidity.

While the action of prices through the majors was mainly declining a few percentage points, the high lever effect used by altcoin retail merchants has probably amplified their losses. In total, $ 625.5 million in liquidations were on long positions, which suggests that the sale took many bulls off guard after weeks of upward dynamism.

Other strongly struck tokens included Solana soil at $ 41 million, Dogecoin (DOGE) at 40 million dollars, and DEFI token smaller like SPK and PUMP when seeing more than $ 10 million in wiped positions.

The absence of a clear catalyst and profit taking near the key resistance levels may have exacerbated the sale. Ether had recently flirted with the $ 4,000 mark while Bitcoin exchanged above $ 118,000 – levels that had already caused greater wallets.

During the editorial staff, the ETH is down approximately 3.6% over the day to exchange almost $ 3,540, while XRP dropped from $ 6% to $ 3.25, extending its weekly loss to more than 12%. Bitcoin resisted it better, sliding a little less than 2% to oscillate about $ 116,800.

Cryptographic liquidations occur when leverage positions are forcibly closed due to a step beyond the margin threshold of a trader. This usually leads to major losses and can trigger cascade effects during volatile movements.

Traders use liquidation data to assess the feeling and positioning of the market. Large long liquidations often report panic bottoms, while short liquidations can precede compression.

Pics of liquidations also help to identify overcrowded professions and potential inversions. When associated with data open on interest and financing rate, liquidation measures can offer strategic entry or exit points, in particular in the suspended markets subject to rinsing or sudden gatherings.