Ethereum prices action has formed a consolidation model between $ 2,500 and $ 2,540 with a decrease in volume suggesting accumulation rather than a distribution.

The cryptocurrency remains trapped below the level of critical resistance of $ 2,800 which has acted several times as a barrier in recent weeks, the traders watching closely an escape which could trigger a renewed momentum around $ 3,000.

Meanwhile, the development activity has reached record levels with more than 35 million ETH now locked, which potentially reduces supply in circulation while geopolitical uncertainties continue to inject volatility between the financial markets.

Technical analysts note that Ethereum can approach a potential “golden cross” – a bullish signal that occurs when the 50 -day mobile average exceeds 200 days – an indicator that has historically preceded significant increase trends.

Distribution of technical analysis

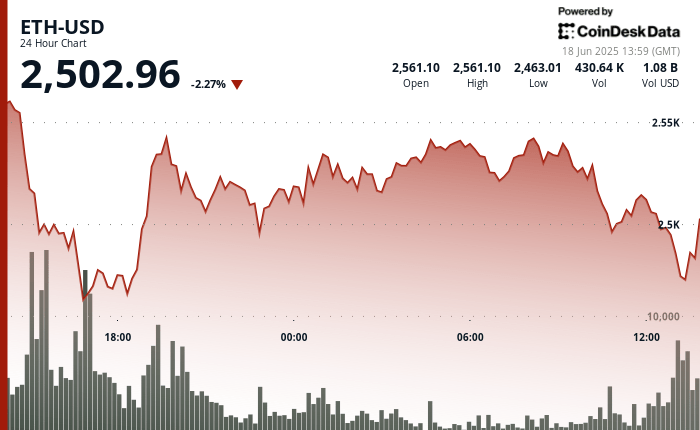

- ETH experienced a negotiation range of 4.05% ($ 106.11) over 24 hours, with a sharp drop of $ 2,564.28 to $ 2,455.95, followed by a recovery.

- A strong volume medium appeared in the zone from $ 2,490 to $ 2,500, establishing a critical technical floor which pushed several downward tests.

- The price action has formed a consolidation model between $ 2,500 and $ 2,540 in the second half of the period, with a decrease in volume suggesting an accumulation rather than a distribution.

- The ETH experienced an important optimistic escape at 11:43 am, from $ 2,506 to $ 2,517 with a high volume (5,876-8,096 units).

- The sale pressure emerged approximately $ 2,515, creating a descending channel culminating in a sharp drop at $ 2,503 between 12: 19-12: 22.

- The share price action has formed a clear V recovery scheme, with the $ 2,503 area to $ 2,504 established as a critical short -term support.

Warning: Parties of this article were generated with the help of AI tools and examined by the Coindesk editorial team for precision and membership of our standards. For more information, see the complete Coindesk AI policy.