Ether

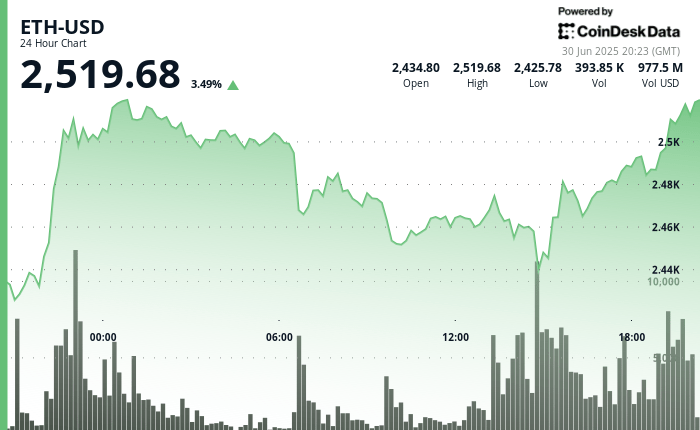

3.5% in the last 24 hours at $ 2,519 from 18:59 UTC on June 30, according to the Technical Analysis model of Coindesk Research, supported by continuous institutional demand, network upgrades and the main retail platform integrations.

The institutional interests remain robust, Coinshares reporting $ 429 million in net entries in Ether investment products in last week and almost $ 2.9 billion year by year. This trend has coincided with a drop in ETH supply on exchanges and the increase in implementation levels, with more than 35 million ETH – a round 28% of the total offer – now locked in assistance proof contracts. Market analysts suggest that these factors reduce the supply of liquid and strengthen Ether’s long -term investment thesis.

Robinhood announced on Monday that he was developing his own layer 2 blockchain using the Rollup infrastructure of Arbitrum. The network is not yet live, but the initiative will eventually support the staging of Ethereum, the trading of tokenized stocks and perpetual crypto. Although the L2 is under development, the decision to build it on the Ethereum Rollup ecosystem is considered a long -term vote of confidence in the Ethereum scalability roadmap.

The co-founder Ethereum Vitalik Buterin also introduced a new digital identity framework using zero knowledge of knowledge. This system allows users to verify traits or identification information without revealing private data and is designed to help web3 applications integrate identity systems preserving confidentiality. Analysts consider this to be a key step towards the wider adoption of decentralized applications requiring sensitive authentication of users.

Meanwhile, the Ethereum community conference (Ethcc) Launched in Cannes, in France, bringing together more than 6,400 participants and 500 speakers. The event presents the dynamics of Ethereum developers through presentations on new tools, scaling strategies and improvements in the protocol.

Despite the positive momentum, the ETH remains just below its 200 -day mobile average, which suggests that technical barriers still exist. However, the confluence of entries, progress of developers and scaling plans continues to support a constructive perspective.

Strengths of technical analysis

- Ether exchanged between $ 2,438.50 and $ 2,523 from June 29 7:00 p.m. June 6:00 p.m., marking a range of 3.47%.

- The largest increase occurred during the UTC window from 22:00 to 23: 00 on June 29, when ETH jumped 2.9% over a volume of 368,292 ETH, briefly pushing through the $ 2,500 barrier.

- On June 30 at 3:00 p.m. UTC, ETH found solid support around $ 2,438 over a volume above average, confirming bullish soil.

- A local summit of $ 2,523 was reached earlier in the day, establishing resistance just above the psychological level of $ 2,500.

- During the last hour from 6:00 p.m. to 6:59 p.m. UTC on June 30, ETH went from an intra -day peak of $ 2,499.19 to close to $ 2,487.19.

- A net ascending movement between 18: 20-18: 21 saw eTH climb 1.6% on the volume of 6,318 ETH, blocking nearly $ 2,499.

- At 8:23 pm UTC on June 30, ETH exchanged $ 2,519, up 3.49% in 24 hours, reporting a bullish momentum renewed in the Asian Open.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.