Ether (ETH)

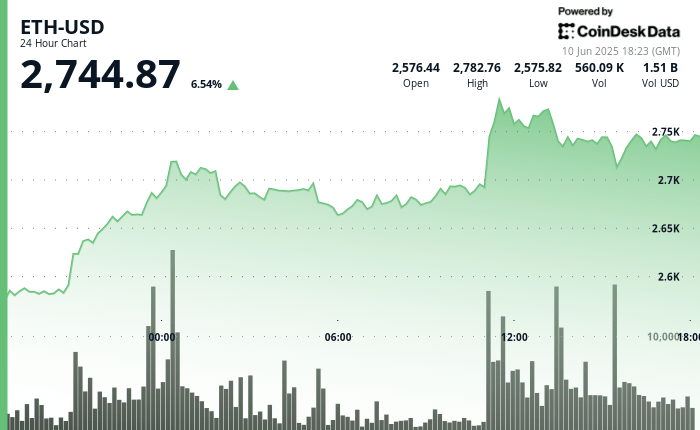

started the 24 -hour session around $ 2,576 at the start of Asian negotiation, fell briefly at $ 2,562 in light volume, then saw an increase in purchase interest around 9:00 p.m. UTC on June 9, while turnover exceeded 436,000 pieces, according to the Coindek Research technical analysis model.

A second wave of request just before 11:00 am UTC on June 10 led ether through the $ 2,700 barrier to a higher $ 2,783; At the time of the press, it was negotiated at $ 2,744.87, up 6.54% out of 560,900 pieces (1.51 billion dollars).

Social feeling has become resolutely optimistic. A popular merchant on X said that this decision was entering a real “stupid fashion” phase after having dismissed $ 1,500 and $ 2,200 barriers and planned to increase around $ 4,000 and beyond.

In a thread X on June 3, the founder of Consensys, Joseph Lubin, described Etheruem as a constantly stopped layer of settlement which treated more than 25 billions of dollars in transactions last year and serves as a skeleton for the floors, tokenized assets, the native yield and the challenge. He added that a private investment of $ 425 million in Sharplink Gaming (SBET) aims to expose traditional investors to these performance opportunities.

Meanwhile, in a market note, the QCP capital underlined the geniuses law, has renewed the buzz around the Introduction on Circle and an increasing regulatory clarity for stablescoins as convergent tail winds which could generate disproportionate structural gains for tokenization and ether regulations.

The chain fundamentals also reinforce the optimistic case: stretch ether recently reached a record of 34.65 million tokens – locking around 28.7% of the offer – and can tighten offers around current support almost $ 2,720.

Strengths of technical analysis

- Ether staged two eruptions supported in volume: first above $ 2,600 on June 9 (436K ETH exchanged), then more than $ 2,700 on June 10 (560.9K ETH).

- A clear series of highest hollows and higher highs underpin a strong upward trend of $ 2,562 to $ 2,783.

- A high volume supply area is now at $ 2,796, marking short -term resistance.

- A double background formed between $ 2,720 and $ 2,740 could support consolidation before light up.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.