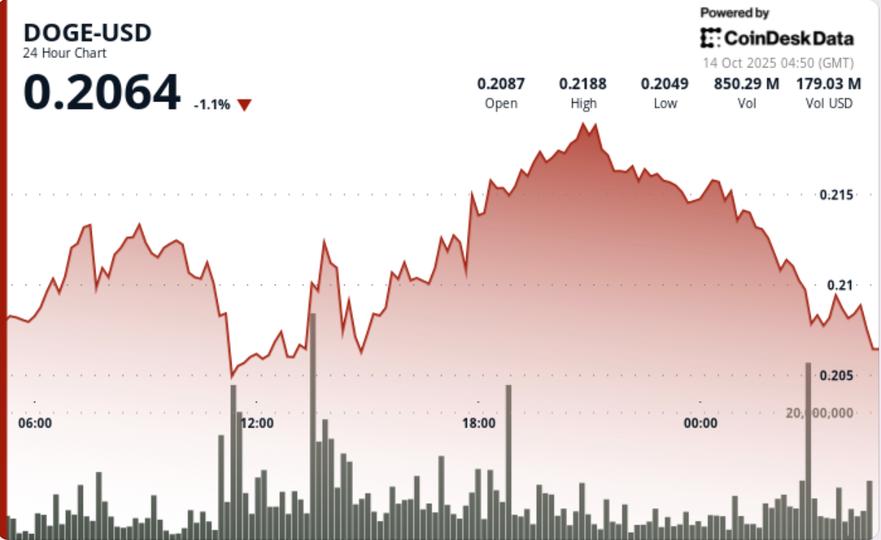

Dogecoin was volatile during the October 13-14 session, sliding 1% after failing to maintain a breakout above $0.22. The token encountered strong demand near $0.20 as institutional flows persisted, even as broader markets reacted to changing trade rhetoric and renewed regulatory scrutiny following House of Doge’s debut on Nasdaq.

News context

Markets stabilized after the Trump administration softened its tone on Chinese tariffs, triggering a partial rebound in risk assets. DOGE rebounded from a low of $0.18 earlier in the week to test resistance at $0.22 before profit-taking emerged. The listing of House of Doge – the coin’s affiliated entity – via a reverse merger on Nasdaq amplified corporate exposure to digital assets, but also raised regulatory compliance concerns for institutional investors.

“The participation patterns we see (high sales volume in the morning and disciplined accumulation in the evening) are hallmarks of active institutional management,” said a senior strategist at a digital asset trading desk. “Treasury teams hedge volatility but do not exit positions. »

Price Action Summary

- DOGE fluctuated between $0.20 and $0.22 from 03:00 on October 13 to 02:00 on October 14, closing at $0.21.

- Resistance topped out at $0.22 after a rejection at 9:00 p.m. on above-average volume.

- Heavy institutional buying appeared near $0.20 during the 11:00 a.m. session with 1.52 billion tokens traded.

- A liquidation blast at 1:54 a.m. resulted in a breakout of $0.21 on volume of 39.6 million as algorithm selling triggered stops.

- The session stabilized around $0.21 with a steady accumulation until the close.

Technical analysis

DOGE continues to oscillate within a band of $0.20 to $0.22, consolidating recent gains of 11%. Support remains well defined at $0.20 with several high volume bounces. The $0.22 cap has now been tested three times without sustained follow-through, forming a short-term pivot for momentum traders.

A concentration of volume at $0.21 indicates institutional stockpiling rather than panic distribution. If price sustains above $0.21 in the next session, upside targets reappear towards $0.23 to $0.24; not defending $0.20 risks falling back towards $0.18.

What traders are looking at

- If DOGE can recover and hold $0.22 to confirm the continuation towards $0.24.

- Signs of renewed whale inflows after 1.5 billion tokens piled up to support near $0.20.

- Corporate and regulatory headlines related to the listing of House of Doge.

- Broader coin sentiment as XRP and SHIB trade flat on falling volume.