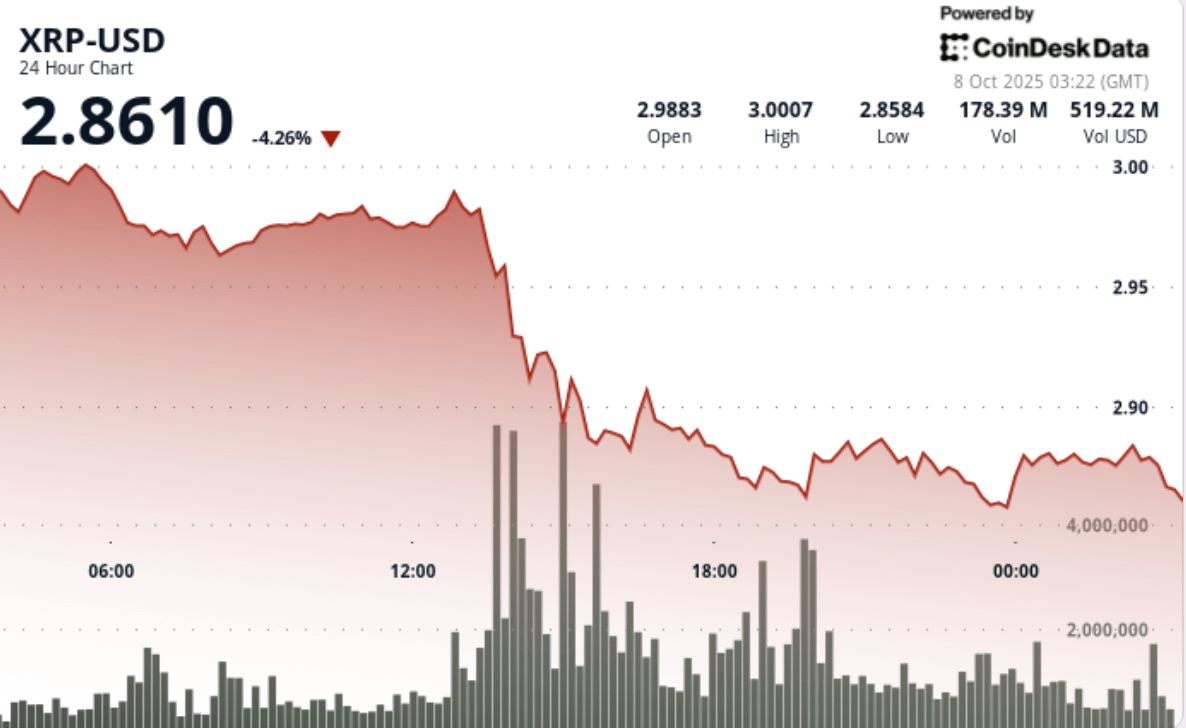

XRP fell nearly 4% during Tuesday’s session as institutional selling reached mid-day and forced a breakdown of the $2.99 resistance zone.

A volume surge near seven times the daily average confirmed liquidation flows, with price stabilizing only after hitting support at $2.878.

Traders are now watching to see if the $2.85 to $2.87 band can hold ahead of Ripple’s bank charter review deadline.

News background

- Ripple’s push for a national banking charter in the United States has come under intense scrutiny from regulators, with the OCC deadline of October 7 marking a key moment in the review.

- Global Macro Remains a Drag: Trade Disputes and Divergent Central Bank Policy Continue to SAP FX and Crypto Liquidity a Headwind for Enterprise-Oriented Tokens Like XRP.

- On Binance, custodial reserves increased by ~19% over the week, suggesting distribution pressure even as a whale buildup continues on-chain.

Price Action Summary

- Resistance: $2,993 confirmed as a ceiling after repeated rejections on high volume.

- Breakdown: The heaviest decline occurred between 1:00 p.m. and 3:00 p.m. UTC, as volumes exploded to 586.9m and the price collapsed to $2.878.

- Range: 24 hours covering $0.144 (4.8%) – wider than recent sessions, highlighting shaky order books.

- Recovery: The final hour rebound from $2.858 to $2.881 (+0.8%) reflected near-term stabilization as algos exploited thin liquidity.

Technical analysis

- Resistance: $2.99 - $3.00 Remains the firm ceiling.

- Support: $2.85 to $2.87 Tape is key; Failure opens a path to $2.70.

- Volume: 7x daily average on liquidation flows highlights institutional exit pressure.

- Trend: Lower highs under $3.00 – bearish bias until reversal signals emerge.

- Momentum: A small recovery late in the session suggests near-term stabilization, but a broader pattern remains fragile.

What traders are watching

- Whether XRP holds $2.85 to $2.87 or extends down to $2.70.

- Ripple’s OCC Charter Decision and Its Impact on US Regulatory Positioning.

- Bitcoin’s $125,000 Breakout – Is It Dragging Altcoins Higher, or Is XRP Decoupling?

- Whale casting after binance reserve growth and wider on-chain distribution models.

- SEC’s October ETF decisions as potential sentiment catalyst.