New context

XRP extended its rally on August 23, while institutional negotiation volumes increased above the averages, strengthening the bullish feeling after weeks of consolidation. This decision coincided with the remarks with the Fed chair, Jerome Powell in Jackson Hole, which strengthened the expectations of the September rate cuts and triggered the rotation of risk assets, including cryptocurrencies.

The regulatory clarity following the results of the Ripple litigation continues to support institutional flows, while analysts now indicate ambitious objectives from $ 5 to $ 8 if XRP is breaking decisively above the short-term resistance.

Summary of price action

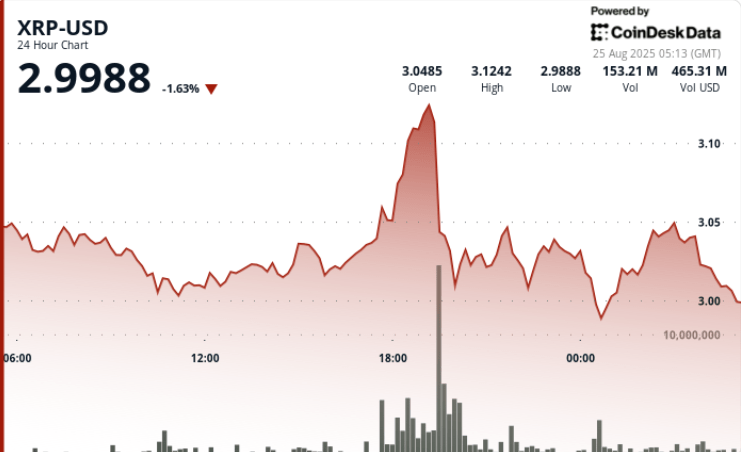

• XRP climbed 3% during the period 24 hours a day, August 23 from August 3 to 2:00 p.m., from $ 3.02 to $ 3.09 before consolidating $ 3.02.

• The token exchanged in a strip of $ 0.09, culminating at $ 3.09 over a high volume of 58.8 million, much greater than the average of 24 hours of 33.2 million.

• The support formed almost $ 3.00 during the candle of 11:00 out of 46.6 million bearings, validating demand at the psychological level.

• XRP ended the session almost $ 3.02, suggesting a renewed momentum while consolidating below the resistance.

Technical analysis

• The resistance remains firm at $ 3.08 at $ 3.09, defined by high volume rejection during the midnight rally.

• The support solidified approximately $ 3.00 after several rebounds with a higher participation in the average.

• Volume peaks confirm institutional flows, with $ 27 million XRP reported in one minute by Fiatleak.

• Graphic structures resemble double -bottomed and symmetrical triangle models, which suggest that analysts could extend the gains to $ 3.30 and, if they are raped, open a path at $ 5 to $ 8.

What traders look at

• If $ 3.00 is lasting soil during the for -profit phases.

• A decisive break greater than $ 3.30 resistance as a larger target trigger.

• Fed’s political trajectory before September – confirmation of the rate reduction probably maintained the flow of risk assets.

• Accumulation of portfolio of whales and volumes of chain settlement, which increased by 500% to 844 million earlier in the week.

• A wider correlation with actions, because weaker yields continue to push crossroads into digital assets.