posted a 4.3% gain over the past 24 hours, amid a rally in broader crypto markets, rebounding from yesterday’s sharp declines.

The broader market gauge, the CoinDesk 20 Index, was 2.5% higher at press time.

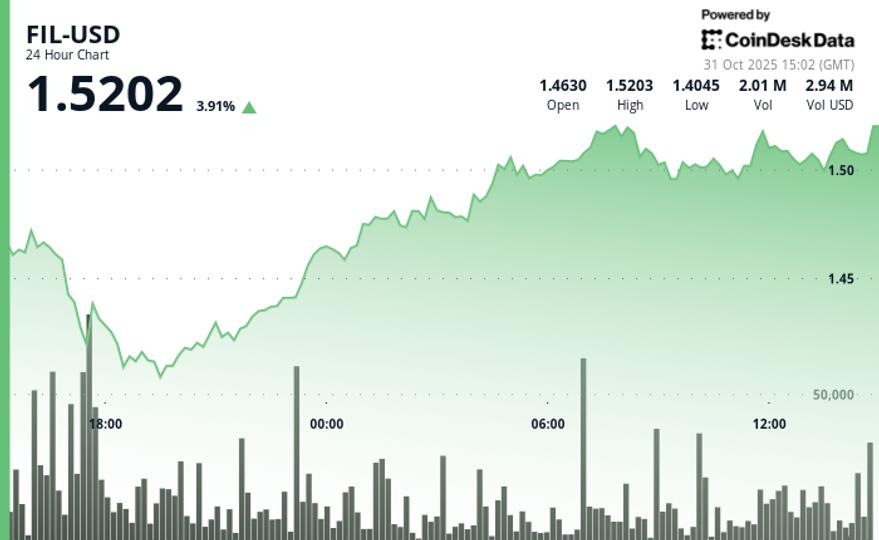

The decentralized storage token traded from a low of $1.40 to a high of nearly $1.52, as traders tested critical support and resistance levels within an ascending channel structure, according to CoinDesk Research’s technical analysis model.

The pattern showed a key development on October 30 at 5:00 p.m., when the volume reached 5.46 million tokens. This was 98% above the 24-hour moving average.

The rise coincided with a decisive low at $1.41, according to the model. Critical support remained firm during subsequent retesting. Each rally wave has shown increasing buying interest on declining volume. This suggests institutional accumulation above the $1.41 area.

Technical analysis:

- Critical support established at $1.41 with secondary support at $1.48; resistance emerging near $1.52 with potential extension to previous highs

- High volume accumulation pattern at $1.41 support with 98% upside above average; declining volume in subsequent rallies suggests controlled institutional buying

- Ascending channel structure intact with higher low pattern; Test of the $1.516 ceiling passed with measured pullback

- Bullish target at $1.52 resistance zone; risk management below $1.41 support with stop-loss considerations around $1.38 for aggressive positions

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.