Queue According to the Technical Technical Analysis Technical Analysis Analysis model, followed by a decrease of 2% as volatile trading configurations emerged in the midst of evolving market dynamics.

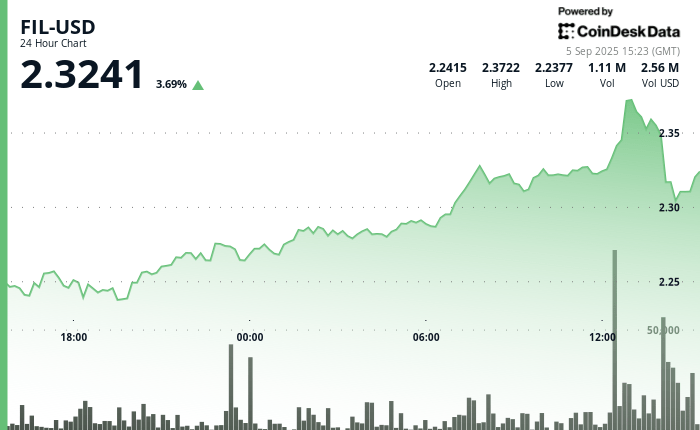

During recent trading, Fil was 3.4% greater than 24 hours, exchanging around $ 2.32.

The model has shown that the overall negotiation range was $ 0.15, 6%, between $ 2.23 and the $ 2.38 summit.

Critical resistance materialized at $ 2.38 with high volume rejection during advanced negotiation activity, depending on the model.

The wider market of cryptography has been little changed, with the large market market, Coindesk 20, up 0.2%.

Technical analysis:

- Thread went from $ 2.25 to $ 2.32 representing a gain of 3% in the previous period of 24 hours

- Global negotiation range included $ 0.15 (6%) Between the absolute Nadir of $ 2.23 and Zenith of $ 2.38.

- Two distinct rally phases were identified: a preliminary ascent at $ 2.28, followed by another climb on September 5.

- Price trajectory culminated at $ 2.38 over an exceptionally high volume of 7.23 million, considerably exceeding the average of 2.47 million 24 hours.

- The critical resistance materialized at $ 2.38 with high volume rejection during the advanced negotiation activity.

- Support levels are consolidated around $ 2.23 to $ 2.24 during initial negotiation hours.

- The later drop from $ 2.36 to $ 2.32 representing a 2% contraction in the last 60 minutes.

- Exceptional volume peaks reaching 425,701 indicating institutional sales pressure.

- The substantial institutional sales volume culminated almost double the average of the session during the end time.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.