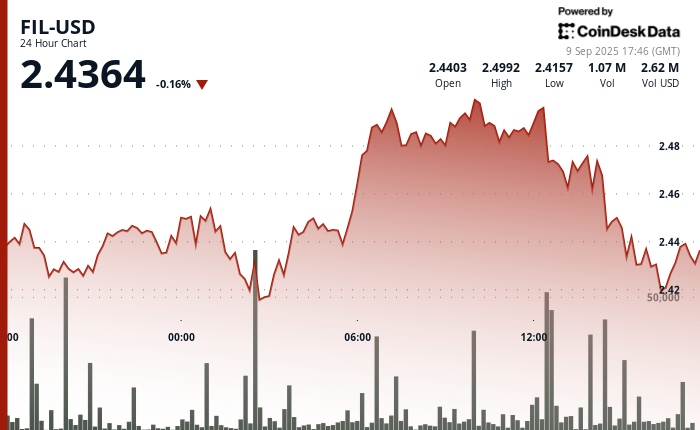

Queue Exchanged little changed in the last 24 hours, the shares negotiating in a range of $ 0.08 representing a volatility of 3.3% between $ 2.41 and $ 2.50, depending on the Technical Analysis of Coindesk Research.

The model showed a pronounced V recovery trajectory, because the digital asset was initially withdrawn from $ 2.44 to test institutional support levels almost $ 2.41 to $ 2.42 during night negotiations, before mounting a sustained rally which reached $ 2.50 during morning hours.

The sale pressure emerged in terms of resistance of $ 2.50 with an institutional volume reaching 4.7 million tokens, while the price zone of $ 2.41 to $ 2.42 demonstrated robust institutional support thanks to several successful support tests, with the volume of negotiation exceeding the average of 24 hours of 2.80 million units, depending on the model.

During recent negotiations, the thread was 0.3% over 24 hours, exchanging around $ 2.43.

The wider market of cryptography was also lower, with the large market market, the Coindesk 20, down 0.8%.

Technical analysis:

- The V -shaped institutional recovery model materialized during the negotiation session 24 hours a day.

- A solid support established in an area from $ 2.41 to $ 2.42 thanks to several successful institutional tests.

- High volume resistance identified at the institutional level of $ 2.50.

- Institutional negotiation volume greater than the average of 4.70 million during the main resistance tests of companies.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.