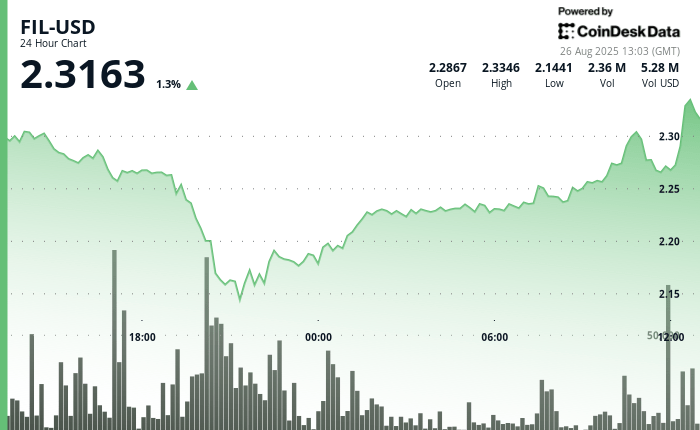

Queue Rebounded 6% compared to its 24 -hour hollows in a strong bullish reversal, according to the Technical Analysis model of Coindesk Research.

The model has shown that FIL had demonstrated resilience with a regular up of $ 2.15 to end at $ 2.31, offering a 6.4% rebound which signals the underlying accumulation and the potential trend reversal.

The wire trading volume was 75% above the 30-day averages, signaling an increased institutional interest.

The storage token has established solid support levels during the rebound, depending on the model.

The Fleccoin rebound came while the wider cryptography market has dropped, with the wider market gauge, the Coindesk 20, down 2.1%.

During recent negotiations, Fil was greater than 0.9% over 24 hours, exchanging around $ 2.31.

Technical analysis:

- The price range extends over $ 0.15 (6.8%) Between $ 2.31, peak and $ 2.15 during the session 24 hours a day.

- A sharp drop of $ 2.26 to $ 2.15 on August 25 between 7 p.m. and 8 p.m. UTC, with a heavy volume of 15.1 million establishes support.

- The recovery model shows a rebound of 6.4% of $ 2.15 low at $ 2.28, indicating an underlying accumulation.

- Breakout above $ 2.27 Resistance at 11:50 am UTC on August 26 triggers a sustained purchase pressure.

- The 20 -minute final rally from $ 2.27 to $ 2.89 with a high volume exceeding 150,000 tokens confirms institutional flows.

- Classic accumulation behavior with consolidation around $ 2.27 support zone at 11:47 am UTC.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.