The prices remain under pressure and the feeling is so weak that one might think that it is again in 2022, but for the first time in almost a year, the Bitcoin whales (BTC) are buying.

After months of distribution, Bitcoin has reached a record greater than $ 109,000, so -called whales – portfolios holding 10,000 BTC or more – accumulate significantly as prices decrease to just over $ 80,000, according to Glassnode data.

The last time the whales bought so aggressively, it was in August 2024 with Bitcoin of the fork from $ 50,000 to $ 60,000, the Yen transport trade was relaxing.

Often considered to be “intelligent money”, whales tend to buy during deep corrections and to sell in force – a model that has been coherent in the past eight months.

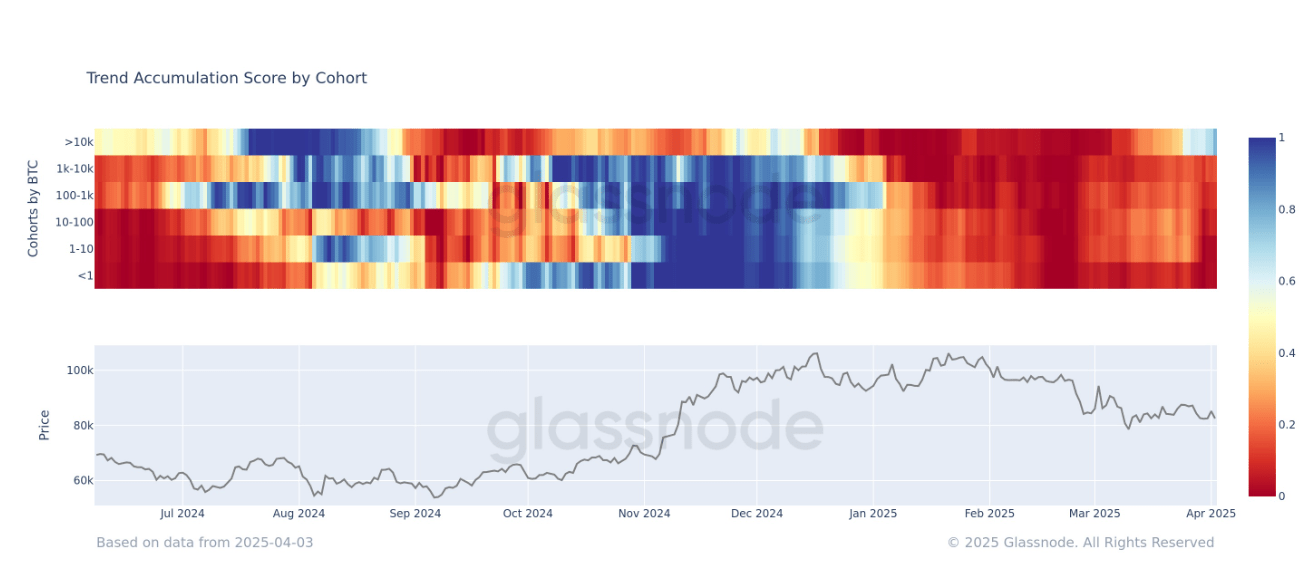

Despite this renewed whale activity, a broader behavior of the market remains lower, Bitcoin is currently decreasing 25% compared to its top of all time. The Glassnode accumulation trend score, which follows the behavior of different wallet cohorts on a 15 -day window, shows that most other groups of investors are still in distribution mode.

A score closer to 1 accumulation of signals, while a score close to 0 indicates the distribution. With a global market score of only 0.15, the sales pressure remains dominant. This suggests that while whales are starting to buy the decline, the wider feeling of the market continues to look down, which potentially drops with an additional drop on the price – at least in the short term.