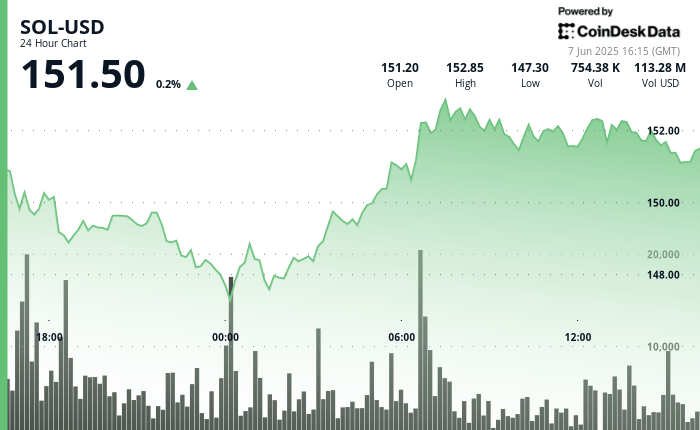

showed a renewed force on Saturday when it bounced to a hollow of $ 147.13 to exchange above $ 151, despite the persistent world macroeconomic winds. The recovery comes in the middle of an increase in activity on the chain, the days of currency destroyed up at 3.55 billion, this third highest level this year, indicating a movement of long -term tokens.

The $ 147 rebound confirmed a double bullish bottom model, supported by an increase in volume and a return to a short -term bullish channel on the 6 -hour table. Solana is now faced with resistance to general costs nearly $ 152.85, where sellers previously intervened, but a movement above this level could open the door to the $ 155 at $ 157.

While the fundamentals of the Solana network remain strong, the wider macro environment continues to inject volatility into cryptographic markets, with current pricing disputes and China and an increase in global bond yields weighing on the confidence of investors.

Strengths of technical analysis

- Soil joined $ 147.13 to $ 152.94, winning 3.95% intraday.

- The double background formed nearly $ 147.50, signaling a potential trend reversal.

- The resistance develops at $ 152.50 at $ 153.00, capping the momentum upwards.

- Channel Haussier seen on a 6 -hour table, with an amount on the green candles.

- The days of destroyed currency increased to 3.55 billion, its highest third reading in 2025.

- The price fell slightly during the last hour from $ 152.5 to $ 151.77 (0.48%).

- The hourly graph shows a sluggish engulfing pattern; $ 150.85 is short -term support.