The KBW investment bank launched the coverage of the Gemini space station (GEMI) with a market performance note and a price target of $ 27, describing the exchange of crypto as a well-balanced digital asset platform ready for long-term growth.

Nevertheless, the analyst wrote Bill Papanastasiou, Gemini remains for the moment an unprofitable assessment and reduced to the Coinbase competitor is justified “as the impact of

Market execution and risk is high. “”

KBW said that Gemini’s ecosystem, trade, custody, custody, credit cards, development, stablecoins and token actions, offers cross -selling potential as the cryptography market is developing.

The bank has highlighted Gemini’s credit card activities as a key growth engine, noting that it has more than 100,000 users and a strong conversion in exchange activity thanks to the rewards based on cryptography.

Gemini became a public last month at $ 28 per share, assessing the company at more than $ 3 billion.

KBW also underlined the resolution of Gemini’s Geag Problems from Geagi as paving the way for a renewal of marketing and competitiveness.

A new partnership with the NASDAQ could add up to $ 47.7 million in short -term income thanks to childcare and ignition services for companies listed, with additional trends in the trends in tokenization, according to the report.

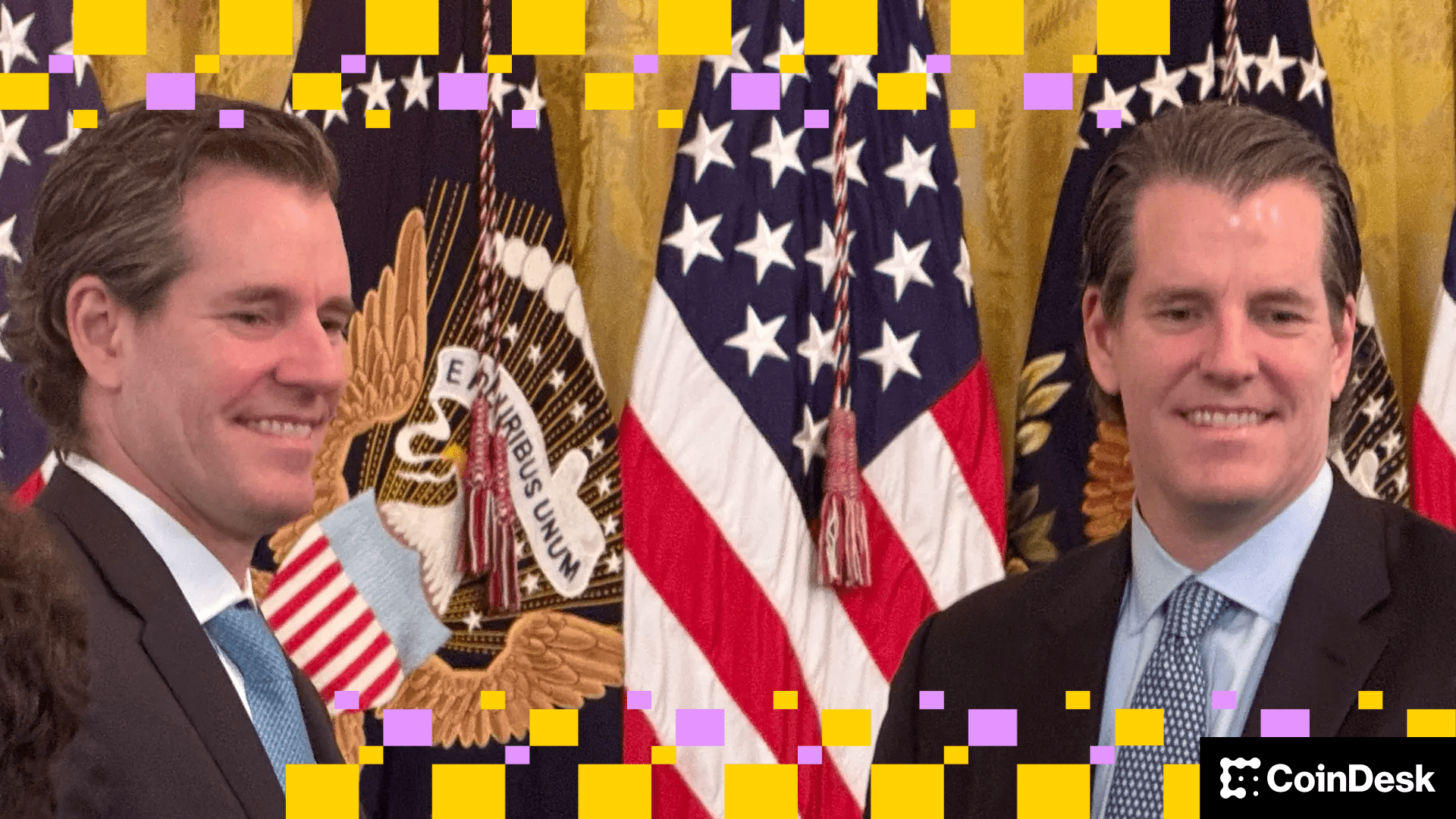

KBW cited Gemini’s unified application and the property of strong initiates, led by the founders Cameron and Tyler Winklevoss, as benefits supporting the stability and growth of users.

Overall, KBW projects 53% growth in annualized income over three years, exceeding peers and expects profitability at the end of 2027, calling Gemini a balanced but promising game for investors betting on a prolonged crypto cycle.

The action was 2% more pre-market at $ 25.80.

Find out more: Crypto Exchange Gemini shares are negotiated below the IPO