Stocks linked to crypto, including Galaxy Digital (GLXY)Internet circle (CRCL) and bitfarms (Bitf) published two -digit gains Thursday under the name Bitcoin The highest pink since mid-August.

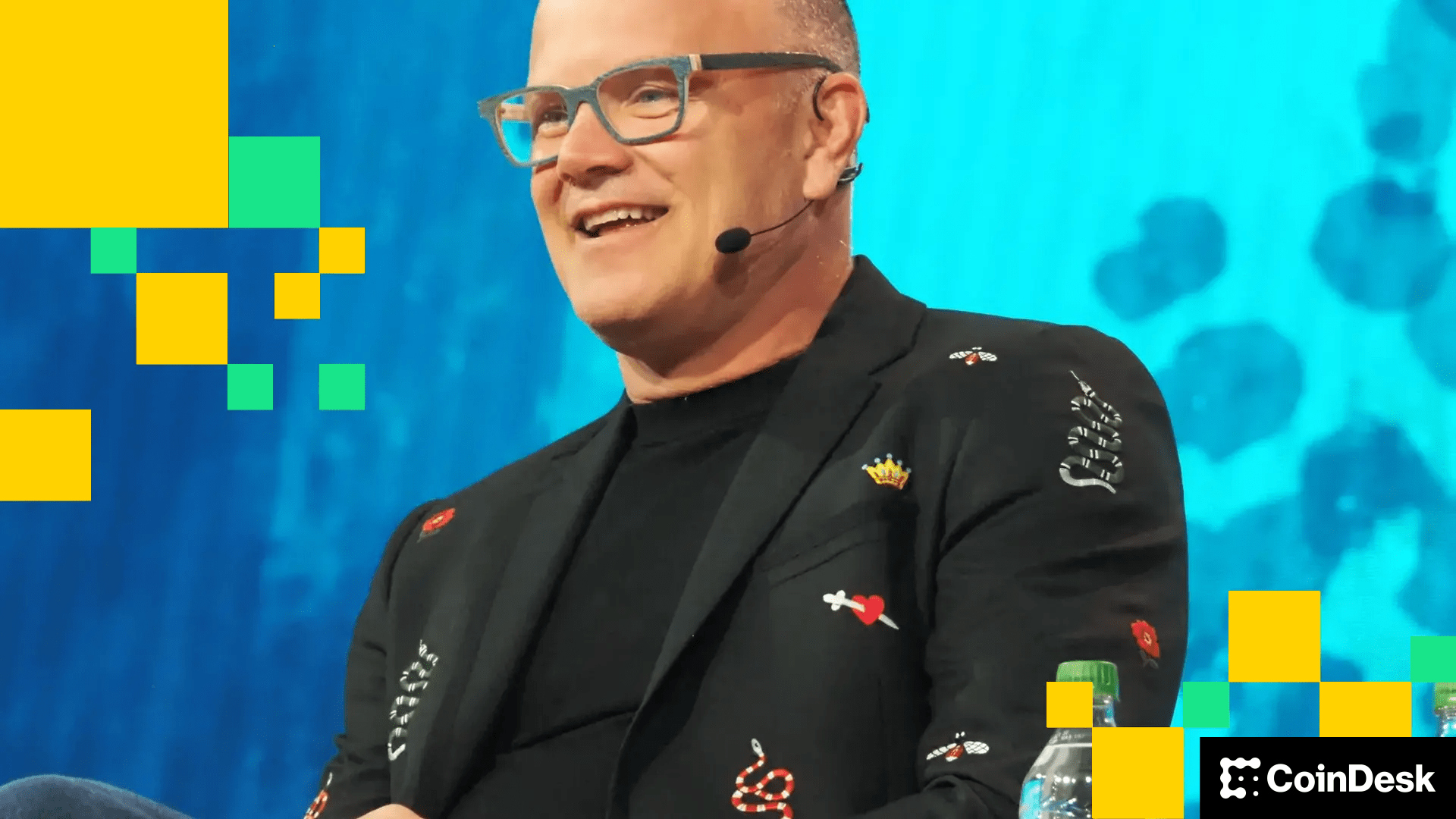

Galaxy, a conglomerate of investment center and data on digital assets led by Mike Novogratz, added 12%. The company was a main investor in the collection of funds of $ 1.65 billion in the Forward Industries closed today to build a Solana Treasury vehicle.

It could also benefit from the growing appetite for data centers, because large technological companies make artificial intelligence of a billion dollars (AI) Accommodate contracts such as Microsoft’s agreement with Nebius on Tuesday.

The same logic applies to Bitfarms Bitcoin Miner (Bitf)Who decided to develop in high performance IT and appointed Wayne Duso, a former Cloud giant manager, the Amazon Web Services web giant on the board of directors last month. The action has advanced still 18% today, extending the gains at more than 60% this week.

For USDC Stablecoin Issueer Circle, the 16% rally on Thursday could be a technical rebound in the absence of any clear new catalyst, breaking the downward trend that started in June and saw the stock decrease to around 60% compared to its post-Opo pic.

Crypto Exchange Coinbase (COIN)Robinhood digital trading platform (HOOD) and bitcoin mara digital minors (Mara) and riot platforms (RIOT) also advanced.

Companies have exceeded wider stock markets, the S&P 500 index, having recently increased by 0.82% and the NASDAQ 100 0.69% index.

Meanwhile, Bitcoin Treasury Vehicles Metaplanet (3355) and Nakamoto (Naka) decreased by 10% and 14%, respectively. Strategy (MSTR)The biggest BTC business owner has changed little.

The decreases occurred while Bitcoin advanced around $ 115,000, bouncing after an initial drop in the increase in inflation of the IPC and reports of higher unemployment at the start of the morning.

Read more: S&P 500 SNUB of Strategy is a warning signal for business bitcoin vouchers: JPMorgan