Gold, often considered as an analog for sound silver, increased by 1% on Monday to establish another record and bring its gain from 2025 to 43%.

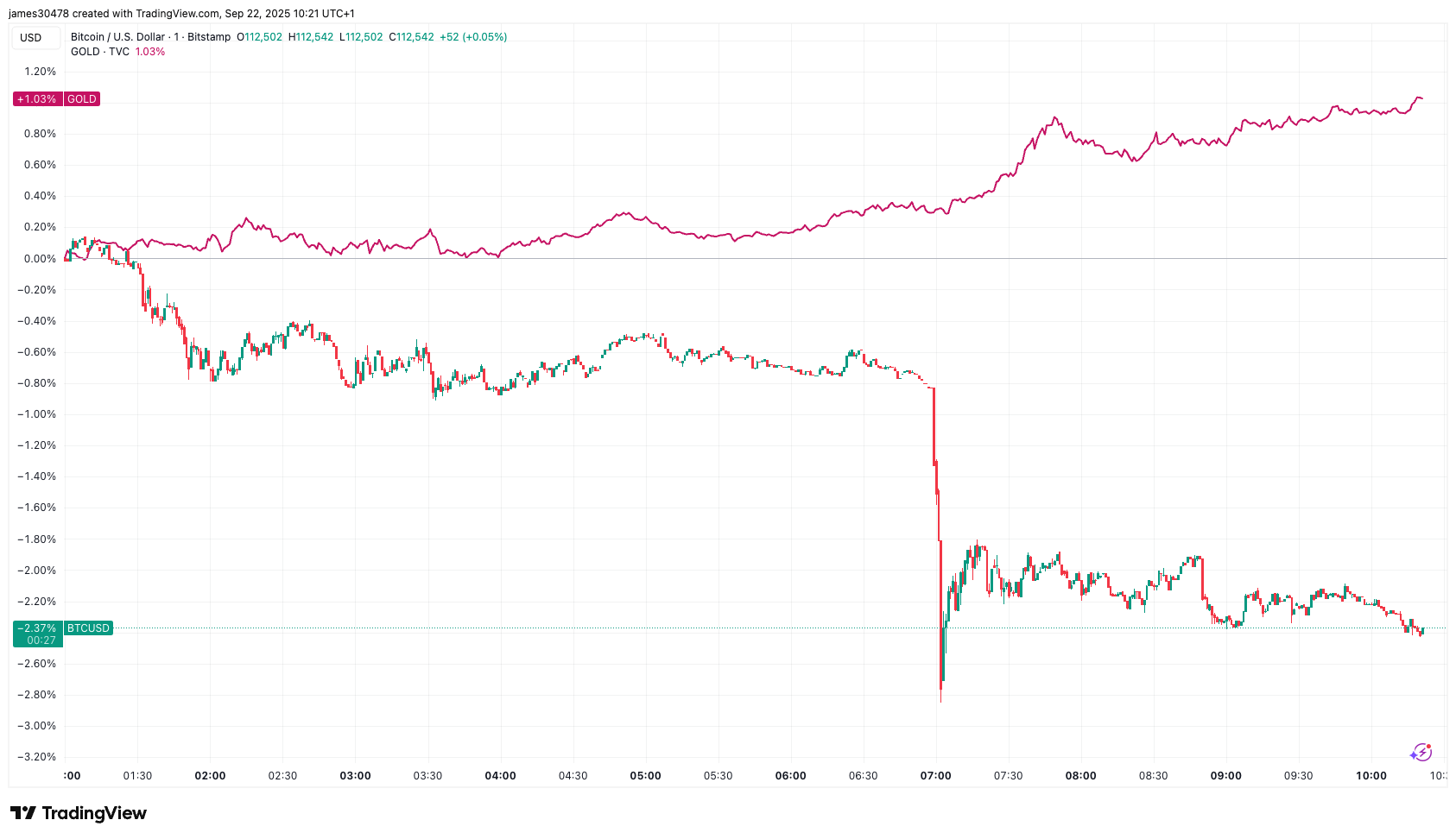

The metal, now negotiating at $ 3,721, advanced about an hour after Bitcoin Considered by some supporters as a digital form of money, displayed a 24 -hour drop by 3% which reduced its price to $ 112,000 and its gain of the year to 17%. The timing suggests the possibility that the benefits of Bitcoin liquidations run gold.

The two active people are rarely moving in tandem, although there are occasional periods when the two increase or decrease simultaneously, often with a short gap. This time, the divergence is stronger.

Gold is not the only metal to attract flows. Silver won 1.5% on Monday to approach $ 44, its third highest level since 1975, and is now more than 50% year.

In particular, since the federal reserve reduced interest rates by 25 base points on September 17, gold and S&P 500 increased by around 1%. At the same time, treasury yields in the United States have increased, with the US 10 years to 4.125% (up 2.5%) and 30 years in the United States at 4.7% (up 2%).

The dollar has strengthened, the Dxy index adding 1% to 97.5. A louder dollar generally exerts pressure on risk assets, and Bitcoin has dropped by more than 3.5% from the Fed movement.