Gold, the world’s largest asset valued at $30 trillion, has outperformed expectations in 2025, rising more than 60% year-to-date to trade at around $4,340 an ounce.

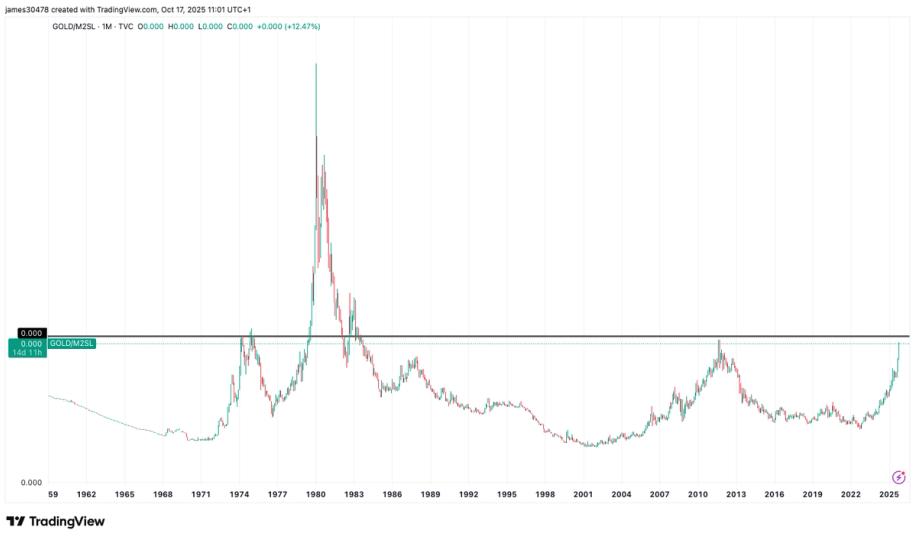

One way to assess the strength of gold is to measure its performance relative to the M2 money supply. (M2 refers to a broad measure of money in circulation, including cash, checking deposits, and savings accounts).

Since its 2022 low, gold has gained around 150% relative to M2. However, it is now approaching historically significant levels last seen during the peaks of 2011 and 1974. This could suggest that the current rally is nearing a peak.

On the other hand, it may also indicate that the bull market still has a long way to go. For example, during the stagflation cycle of the 1970s, gold surged by an additional 180% relative to M2 money supply before reaching its ultimate peak.

Gold performance against Bitcoin

Gold’s outperformance extends beyond the money supply. The gold/bitcoin ratio is now up around 50% year to date.

The price of Bitcoin is now around 24 ounces per BTC, about 40% lower than its all-time high set in December 2024. Additionally, the total market cap of Bitcoin now represents around 7% of the total market value of gold.

Bitcoin is approaching a market cap of $2 trillion, which corresponds to a price level of around $100,000. This price also closely aligns with its 365-day moving average (365DMA).

The 365DMA calculates an asset’s average closing price over the previous 365 days, helping to identify long-term trends and potential support or resistance levels.