Grayscale Investments, an Crypto asset management company that seeks to add XRP and Cardano Exchange funds to its offers, now begins the road for an ETF in investing in the Dot token of Polkadot.

The NASDAQ filed an official request for form 19B-4 from the Securities and Exchange Commission (SEC) of the United States to list and negotiate the actions of the Grayscale Polkadot Trust (DOT). The deposit begins a 45 -day examination period for the regulator in order to recognize the file. The regulator may approve, or disapprove of the request or extend the examination period.

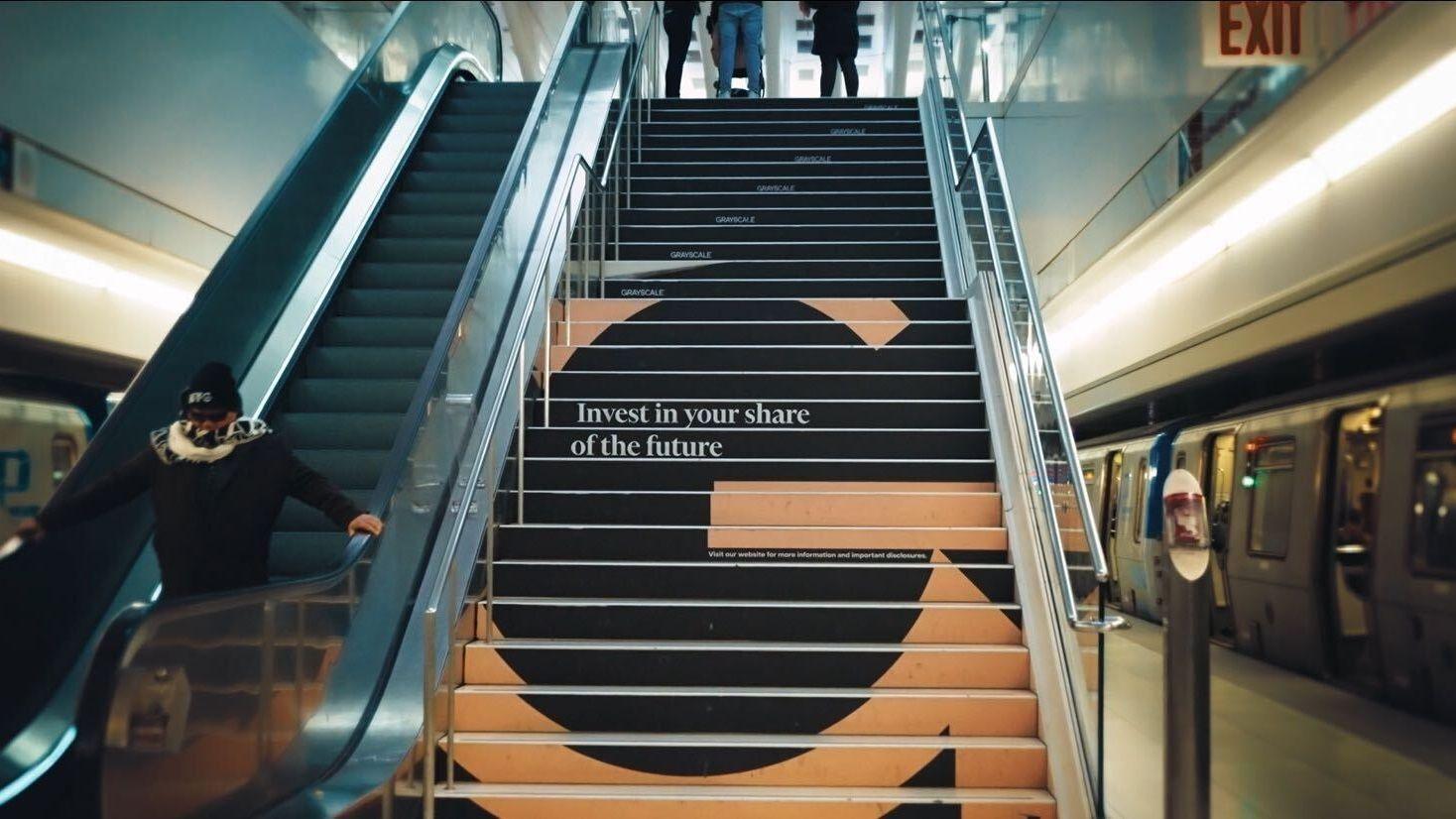

In the past few weeks, Grayscale, which already offers Bitcoin and Ether, has deposited with the dry to convert its Trust XRP into negotiated funds in exchange, and has filed an enumeration of an ETF Cardano Spot. These deposits arise while the SEC approaches a more friendly approach to the digital asset industry under the Trump administration, after recently suppressed numerous surveys related to the crypto, including against Robinhood and the tokens market Not fascinable Opensea.

Graycale has never offered an autonomous polkadot product. The file sees him join Crypto Asset Manager 21Shares, who also submitted a Polkadot ETF file at the dry at the end of last month.

Polkadot’s dowry is at the time of the writing of trade at $ 4.4 after losing 6.7% of its value during the last 24-hour period in the middle of a slowdown in the Cryptocurrency Plus Market wide.