Warning: The analyst who wrote this piece has strategy shares (MSTR).

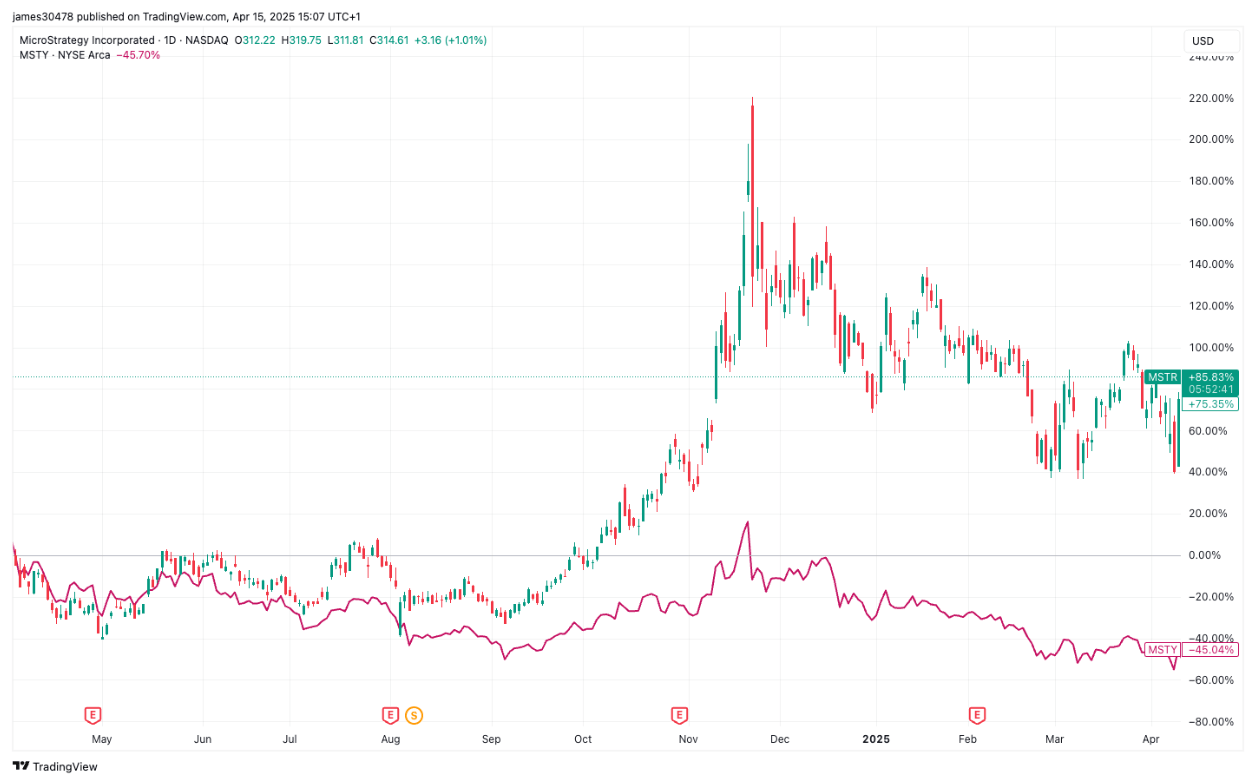

From April 2024 to April 2025, investors in the strategy (MSTR) and the return on income strategy for MSTR options (MSTY) followed two distinctly different investment pathways – one looking for an appreciation of capital through the Bitcoin exposure (BTC), the other continuing the monthly income via strategies based on options. Both are linked to MSTR’s performance, but their results and structures have considerably diverge.

The strategy, listed on the NASDAQ, has gone from a corporate software company in a de facto bitcoin proxy. As of April 15, the company holds 531,644 BTC, which makes its stock very sensitive to Bitcoin price movements. Since the adoption of its Bitcoin cash strategy in August 2020, MSTR’s shares have jumped by 2,500%. However, this growth is accompanied by volatility: currently, the action has an implicit volatility of 87% and a historic volatility of 30 days of 102%. The MSTR is currently 43% below its whole of all time in November 2024, reflecting the typical net fluctuations of an active corrected by bitcoin. The action does not pay any dividend.

On the other hand, MSTY, launched in April 2024, is an ETF focused on income which does not directly hold MSTR shares. The MSTY portfolio consists mainly of American cash, cash, short -term call options on MSTR, which allows it to reproduce the exposure synthetically without having the stock directly.

He uses a synthetic covered call strategy, selling options on MSTR to generate a monthly income. This strategy limits participation in the increase, but provides coherent cash flows, using investors looking for regular distributions.

From April 4, 2024 to April 9, 2025, an investment of $ 1,000 in each product produced the following results:

- MSTR: Fueled by Fort Rallye de Bitcoin in 2024, the investment increased to $ 1895, generating a total return of + 86%.

- MSTY: With 13 monthly distributions totaling $ 36.53 (ranging from $ 4.13 in April 2024 to $ 1,33 in April 2025) reinvested on each date of ex-Dividends, the investment reached $ 1591, a total return of + 59%.

However, MSTY decreased by 45% compared to the year because of its full exposure to the decline in MSTR prices movements, without fully benefiting from MSTR rallies because of its call writing strategy. In addition, coherent high monthly distributions – partly classified as a return to capital – have reduced the value of the fund’s assets over time, weighing more on the course of its action.

MSTY has shown significant full -fledged volatility, often negotiating bonuses or the net value of assets (NAV), by introducing an additional price risk.

Premium / Discount activity in MSTY reflects both the demand for investors and the underlying volatility of the MSTR. Early high volatility has supported income and negotiation premiums for solid options, but as volatility relaxed in 2025, bonuses have shrunk and the discounts appeared more often. However, a renewed bitcoin rally and the increase in volatility in the MSTR could reverse this trend, raising the income of options, distributions and demand from investors.

Although the two products are linked to the action of MSTR prices, they serve separate objectives: MSTR offers high -risk growth potential linked to Bitcoin, while MSTY offers a yield thanks to an income strategy based on derivatives with inherent structural limitations.

Unlike traditional income strategies that focus on low volatility investments, stable, such as wide index ETFs or dividend actions. MSTY is aimed at retail investors looking for an exceptionally high income – but which are also willing to accept much higher risks and volatility.