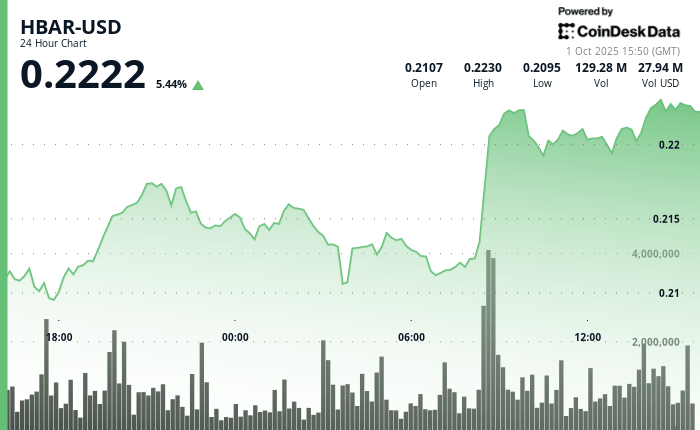

Hbar posted a solid technical performance in the last 23 -hour negotiation window, from $ 0.21 to $ 0.22 while recording a negotiation range of $ 0.012, which is 5.7%.

The market share has been highlighted by a firm consolidation at $ 0.209 in heavy volume before the buyers push the token decisively above the resistance from $ 0.221 to 08:00 UTC.

The escape, supported by more than 125 million chips exchanged, established a new peak almost $ 0.222, which then turned into a new support around the level of $ 0.22. The last hour of negotiation saw another wave, with a high volume thrust from $ 0.220 to $ 0.222, highlighting a continuous burst.

The gains are involved in a renewal of institutional enthusiasm, Hbar climbing approximately 4% in the last 24 hours. Hedera’s positioning has been reinforced by highly publicized partnerships, in particular by working with Swift, Citi and Bundesbank in Germany on interoperability executives. In the United States, the Wyoming decision to take advantage of Hbar for its Stablecoin Frontier initiative has further strengthened credibility, placing the network at the forefront of the blockchain adoption at the level of the state.

Technically, cryptocurrency faces a well-defined beach, with a support established at $ 0.21 and general resistance costs at $ 0.23. The oscillators of Élan, who had recently cooled from the territory of occurrence, suggest that consolidation could give way to continuous increase.

The commercial activity of the last session showed a strong confirmation of volume to key support and resistance areas, indicating that market players are ready to defend the current trend.

Technical indicators report a sustained force

- Consolidated level of support at $ 0.209 with a substantial volume confirmation of 102.98 million during the 5:00 p.m. session.

- Decisive penetration greater than $ 0.221 Resistance at 08:00 with an exceptional volume of 125.71 million units.

- The ascending trajectory suggests persistent purchase pressure and potential continuation to the level of fibonacci extension of $ 0.223.

- Acceleration of volume during the 60 -minute period with an explosive volume of 3.19 million at the break of 14:04.

- Prolonged purchase pressure and volume confirmation exceeding 2.25 million during the period 14: 05-14: 06 validates the optimistic continuation.

- Potential to continue progress towards the level of fibonacci extension of $ 0.225 based on the current characteristics of the quantity of movement.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.