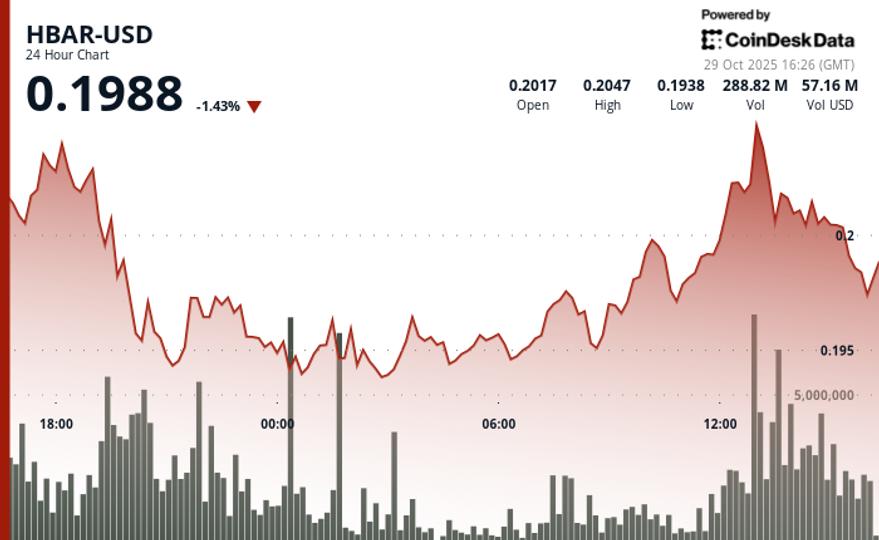

HBAR slipped 0.3% to $0.2010 on Tuesday as sellers reasserted control near key resistance. The token traded in a tight range of $0.0124, moving away from the session high of $0.2059 as technical selling limited the bullish momentum.

An increase in trading volume to 249 million tokens, or 137% above average, confirmed strong distribution at the $0.2055 level, suggesting institutional selling. Support at $0.1938 held through repeated testing, but a series of lower highs at $0.2044, $0.2032, and $0.2017 signal continued bearish momentum.

Intraday volatility intensified between 1:33 p.m. and 1:48 p.m., with sharp swings from $0.2015 to $0.2029 amid bursts of 20.6 million tokens. Trading stopped abruptly at 2:16 p.m., indicating possible market disruption or data issues. The $0.2014 pivot now serves as a key level as traders look to see if HBAR’s $0.1938 support can withstand continued pressure.

The price action follows Tuesday’s launch of a spot HBAR ETF on Nasdaq, which led to a significant intraday increase in HBAR.

HBAR Technical Overview

- Support/Resistance

- Key support at $0.1938 held despite several tests.

- Strong resistance at $0.2055 remains unbroken after repeated rejections in large volume.

- Volume analysis

- The recent volume spike of 249 million tokens marks a 137% increase over the average.

- Indicates institutional selling pressure and concentrated distribution near resistance.

- Chart templates

- The descending trend line confirms the bearish momentum with successive lower highs at:

- Price movement remains limited, but the dynamic favors sellers.

- Targets / Risk-Reward

- Downside Target: A break below $0.1938 support could trigger further weakness.

- Upside Potential: The rally faces resistance at $0.2017 and a strong bid near $0.2055.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.