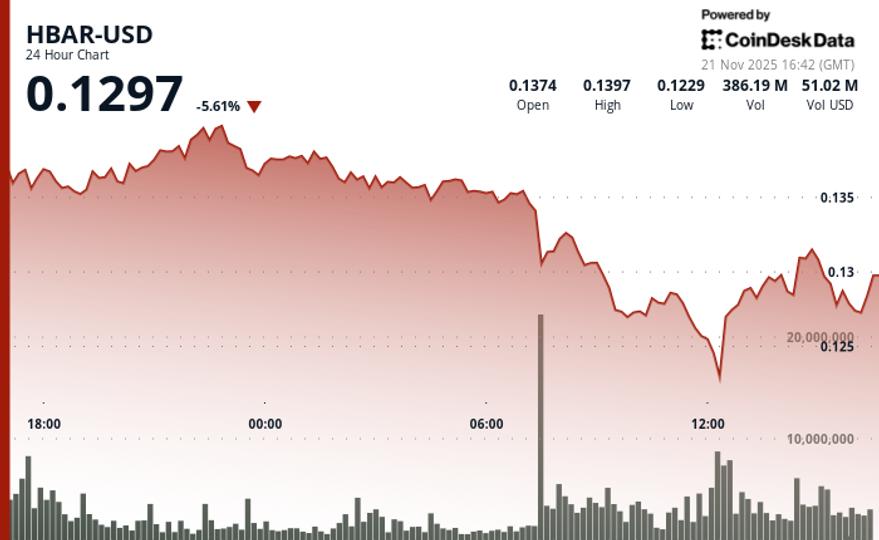

HBAR fell 11.5% on Tuesday as intense institutional selling overwhelmed the market, sending the token from $0.1426 to $0.1281. A massive selling wave of 250.3 million units at 0700 GMT, nearly double the 24-hour average, erased key support at $0.1350 and triggered a cascade of stop-loss triggers. The failure occurred despite the network’s continued development efforts, emphasizing that technical flows, not fundamentals, were the driving force behind the session.

The rout deepened as HBAR recorded consecutive lower highs and greater volume with each step down, repeatedly testing the $0.1277 area. With resistance now firm at $0.1400, the market structure has turned significantly bearish, reflecting broader weakness in the crypto market. The failure to defend $0.1350 on Tuesday became the central turning point, highlighting how institutional positioning dictated price action.

In the final hour of negotiations, the pressure to capitulate intensified. HBAR slipped from $0.1317 to $0.1277 as sharp volume surges hit 8.76 million and 11.13 million in rapid succession before activity abruptly stopped at the session low. The sudden freeze suggests either aggressive absorption or a technical stop – conditions that could pave the way for a reversal if buyers re-emerge, even if bearish momentum remains dominant.

Key Technical Levels Signal Downside Risk for HBAR

Support/Resistance: Critical support holds at the $0.1277 to $0.1281 area, while resistance tops out at $0.1400. The breakout of $0.1350 turns former support into resistance.

Volume analysis: The explosion in institutional sales to 250.3 million marks a 98% increase above average, confirming smart distribution of money versus retail panic selling.

Chart templates: The descending channel locks in place with consistent lower highs and descending lows, breaking key Fibonacci levels throughout the session.

Targets and risk/reward: The next breakout target lies at $0.1250 if current support collapses, while recovery attempts face immediate resistance at old support near $0.1350.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.