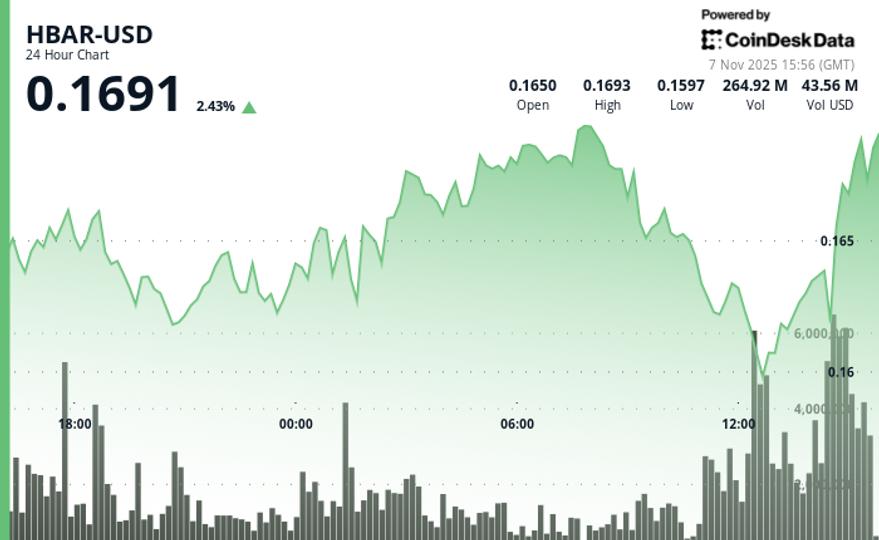

HBAR traded in a volatile range during the 24-hour period ending November 7, falling from $0.1672 to $0.1634, a decline of 2.3%.

The most significant market activity occurred on Friday at 5:00 p.m. UTC, when volume surged to 108.8 million tokens, 46% above the 24-hour simple moving average of 74.6 million.

HBAR’s lackluster price action on Friday mirrors the broader market, with several tokens falling to multi-month lows amid a wave of selling pressure.

Hedera’s token has now retraced the entire uptrend dating back to July, signaling that the market’s recent bull phase is over.

Natural profit-taking occurred on Friday near $0.164, with the next four minutes of zero volume suggesting a market pause at this technical level. This development represents a new potential resistance area that aligns with the upper boundary of the day’s broader trading range and negates the prior bearish consolidation thesis.

Key technical levels signal mixed outlook for HBAR

Support/Resistance:

- Main support stands at $0.1595-$0.1610 area during decline phase

- Key resistance identified at $0.1662 level where recovery attempt fails

- New resistance emerges at $0.164 after late session breakout

Volume analysis:

- Peak institutional activity at 108.8 million tokens (46% above 24-hour SMA)

- End of session acceleration to 3.5 million during breakout attempt

- Volume deceleration during after-hours suggests potential for consolidation

Chart templates:

- Consolidation limited to a range with daily volatility of 5.6%

- Failed to breakout at $0.1662 resistance level

- Late session reversal negates bearish consolidation pattern

Targets and risk/reward:

- Immediate resistance at $0.164 following profit taking

- Bullish target towards $0.1672 daily open if resistance is broken

- Downside risk to $0.1595 support if current level fails to hold

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.