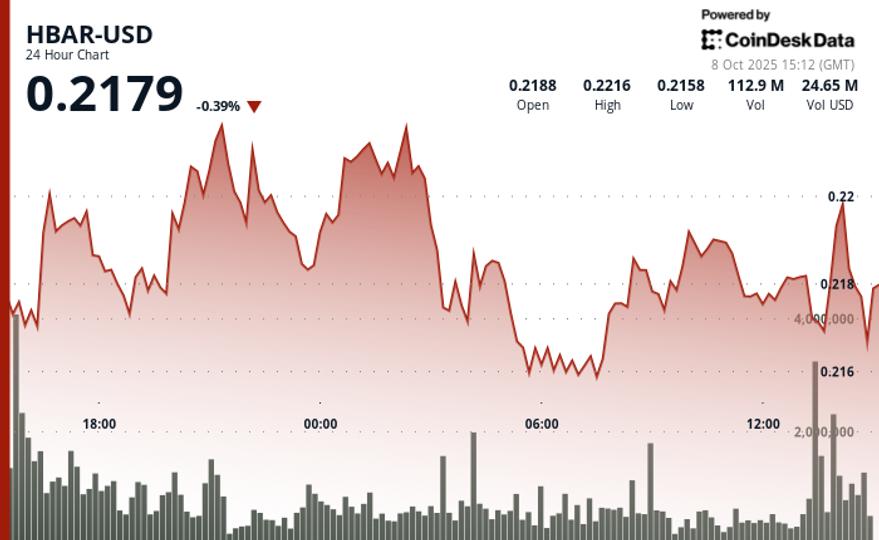

HBAR showed notable resilience during the 24-hour period between October 7 and 8, climbing around 2% from the session low near $0.22 to stabilize around the same level. The token is trading in a tight range, repeatedly testing support and resistance at $0.22.

Despite a sharp drop in trading volume – from 138.43 million to 19.74 million tokens – HBAR maintained a stable consolidation pattern, hinting at reduced participation in the short term but a stable accumulation phase.

Momentum built decisively during the final hour of trading, when HBAR broke out of its compressed formation between 1:12 p.m. and 2:11 p.m. UTC on October 8. After briefly retreating to an intraday low of $0.22, the cryptocurrency reversed sharply, breaking through resistance levels and printing new session highs above $0.22.

This technical breakthrough coincided with broader market optimism regarding the Hedera ecosystem. Institutional enthusiasm continues to build as Canary Capital nears completion of its HBAR ETF spot filing – offered under the symbol “HBR” with a 0.95% management fee – although regulatory progress has been temporarily delayed by the ongoing US government shutdown that has slowed SEC operations.

Technical indicators

- HBAR maintained its trading activity within a limited bandwidth of $0.01 throughout the 24-hour session, fluctuating between $0.22 and $0.22.

- Repeated examinations of support foundations around $0.22 and resistance barriers near $0.22 have set crucial technical parameters.

- Decisive rejection from $0.22 at 01:00 followed by a retracement to validated resistance positioning at $0.22.

- Trading volume contracted significantly from 138.43 million to 19.74 million tokens during the initial phases, indicating reduced momentum.

- Increased volume exceeding 4.3 million tokens throughout the 2:02 p.m. interval indicates institutional commitment.

- A decisive reversal from the session low of $0.22 at 1:45 p.m. validated the conclusion of the consolidation dynamic.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.