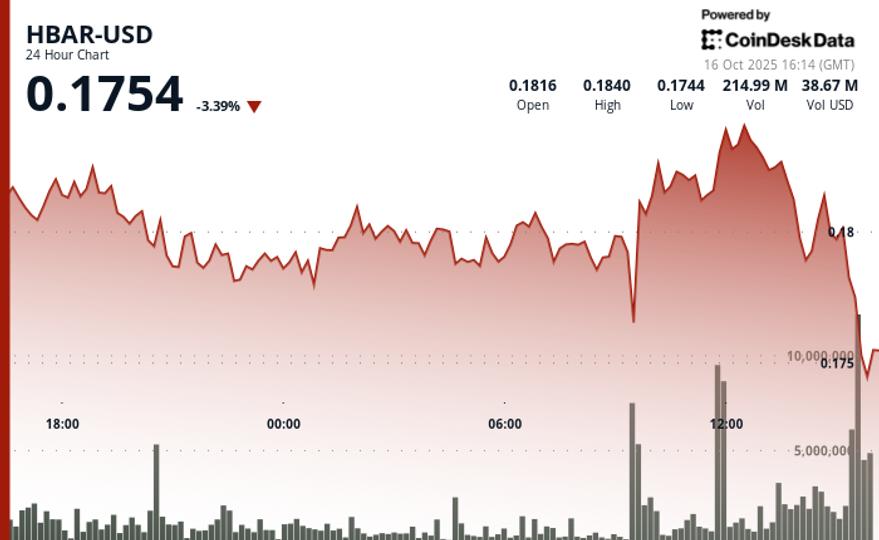

HBAR experienced a volatile 24-hour period as institutional traders managed a narrow but intense range between $0.176 and $0.185. The token initially fell due to corporate profit-taking before rebounding sharply on the morning of October 16, when corporate trading volumes exceeded 129 million.

Despite this recovery, the momentum proved to be short-lived. A sharp reversal occurred during the final hour of trading, when corporate selling pressure overwhelmed previous support areas. Between 2:02 p.m. and 2:04 p.m., volumes exceeded 3 million as HBAR slipped from $0.183 to $0.1805, reflecting aggressive liquidation activity.

Analysts say the move highlights the shift in institutional sentiment toward enterprise blockchain assets. While HBAR’s corporate base has shown resilience in the $0.176 to $0.178 range, sustained resistance between $0.183 and $0.185 suggests increased caution from institutional investors.

Overall, this trend highlights a market caught between profit-taking and structural rebalancing, as companies recalibrate their exposure to blockchain-related tokens amid increasing volatility.

Business technical indicators highlight business market dynamics

- Institutional trading range of $0.01, representing a 5% spread between the company’s low of $0.18 and the company’s high of $0.19.

- Key corporate support area identified at $0.18 to $0.18 levels with multiple instances of institutional buying interest.

- Corporate resistance levels materialized in a range near $0.18 to $0.19 during the corporate recovery phase.

- Volume increase exceeding 129 million between 9:00 a.m. and 12:00 p.m., indicating significant institutional corporate participation.

- Last hour business volume exceeds 3 million, suggesting pressure on institutional liquidation of businesses.

- The exhaustion of the corporate market is evidenced by zero institutional volume in the final minutes of trading.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.