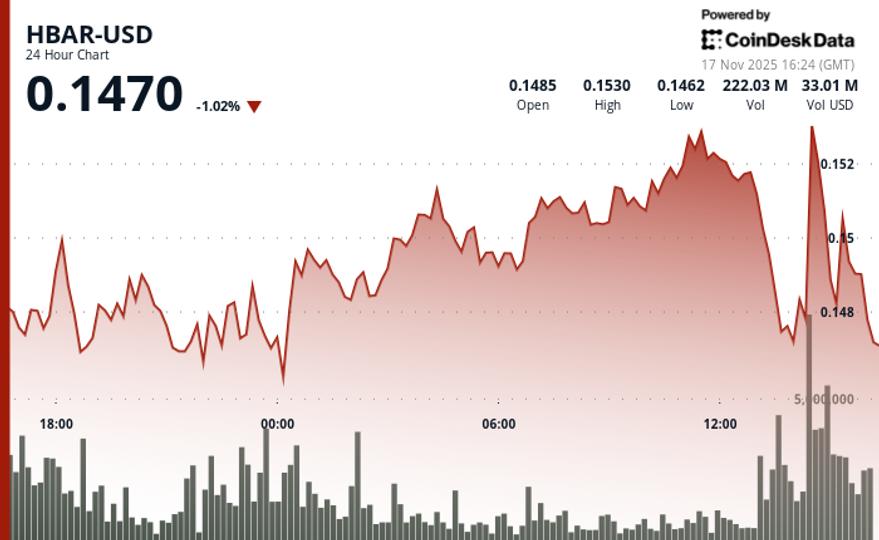

HBAR fell sharply on Tuesday, sliding 2.5% from $0.1518 to $0.1480 after falling below a key support level that triggered a wave of further selling. The move follows a spike in trading activity late on November 16, when 168.9 million tokens changed hands – a 94% jump above average – signaling strong institutional distribution.

Short-term charts show the decline accelerating, with HBAR falling another 2.2% to $0.1472 as volume surged 180% above normal. A series of lower highs carved out a clear descending channel, reinforcing the bearish technical picture used by traders to anticipate short setups.

The sell-off occurred despite renewed optimism around Hedera’s planned integration of Wrapped Bitcoin, which aims to expand the network’s DeFi capabilities by 2025. For now, however, the technicals remain in check, and support at $0.1457 has become the crucial level for bulls trying to stabilize the price action.

Signal Consolidation Breakdown of Key Technical Levels for HBAR

Support/resistance analysis:

- Main support established at $0.1457 following rejection of rising volume.

- Resistance remained intact near $0.1488 after a strong rejection due to high volume.

- Descending channel pattern confirmed with sequence of lower highs.

Volume analysis:

- The peak volume of 168.9 million tokens (94% above the 24-hour SMA) marked a key reversal point.

- Selling pressure on 60 Minutes peaked at 6.2 million tokens during the strongest decline phase.

- Distribution model confirmed by 180% volume increase during outage.

Chart templates:

- Consolidation limited to a range between $0.1460 and $0.1530, broken to the downside.

- Formation of descending channels with established sequential lower highs.

- Institutional distribution model extending a wider distribution of consolidation.

Targets and risk management:

- Next major support target: $0.1457 (set level based on volume).

- Risk Management Level: $0.1465 (recent sharp decline low).

- Upside Resistance: $0.1488 (proven rejection zone on high volume).

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.