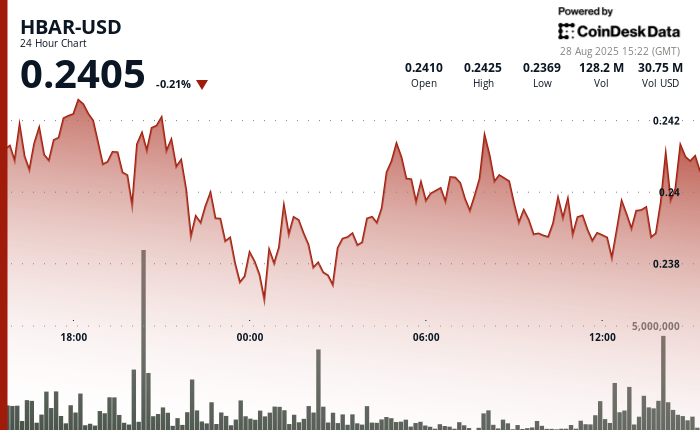

The action of Hbar prices has remained closely contained in the last 24 hours, negotiating in a narrow strip of $ 0.01 between $ 0.24 and $ 0.25. The token was firm at $ 0.24, an area that market players consider a key area of institutional support. The negotiation volumes increased to 179.67 million units during advanced sessions, far exceeding the typical daily averages, a signal for accumulation of interest among larger investors.

This decision comes as the blockchain focused on the company of Hedera continues to gain ground with the main financial and technological players. This week, the World Payment Giant SWIFT launched operational tests for Hedera’s big distributed book technology for the cross -border settlement infrastructure. At the same time, Grayscale has deployed an investment vehicle based in Delaware offering exposure to Hbar, highlighting the growing regulatory and institutional alignment around the assets.

The combination of high trading volumes, close price movements and visible adoption of companies led analysts to suggest that sophisticated investors strategically position for the next Hedera growth phase. The network powered by Hashgraph can treat thousands of transactions per second, a scalability functionality that calls on companies such as Google and IBM while they explore tokenization and other blockchain -based solutions.

Distribution of technical indicators

- Hbar operated in a measured range of $ 0.01 during the period 24 hours a day, August 27 to August 27 to 28:00, fluctuating between $ 0.24 and $ 0.24 with a limited directional moment.

- Digital assets established prices from around $ 0.24 to $ 0.24 where institutional purchases emerged consistently, while the resistance developed nearly $ 0.24 to $ 0.24 where profit taking was materialized.

- The volume analysis revealed a concentrated activity during the 8:00 p.m. on August 27 with 179.67 million of units processed, considerably exceeding the average of 24 hours of 41.75 million units.

- The time of final negotiation has demonstrated a renewal of institutional interests with Hbar regulating at $ 0.24, indicating a supported movement potential on the contingent increase in the maintenance of the volume above the established benchmarks.

- Hbar recorded the volatility measured during the last hour of August 28, 13:23 at 2:22 PM, from $ 0.24 to a session summit of $ 0.24 before settling at $ 0.24, representing a net assessment of 0.33%.

- The period included two notable volume concentrations at 13:42 and 14:13 with 9.20 million and 6.81 million units respectively, corresponding to defined price movements.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.