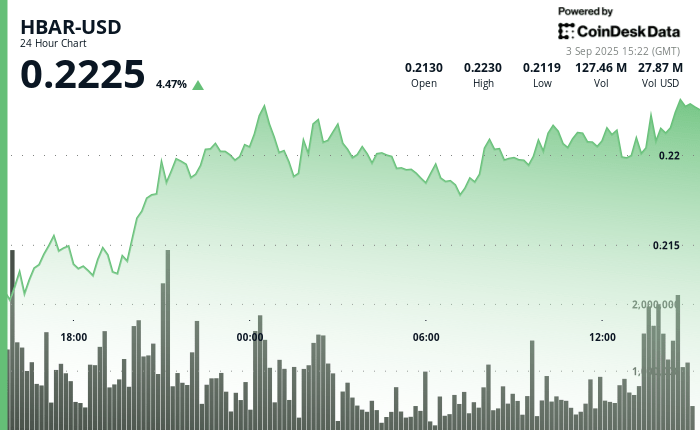

The native token of Hedera, Hbar, has shown signs of bullish momentum in the last 24 hours, winning 3% while altering the turbulence of the moderate market.

Between September 2 at 3:00 p.m. and September 3 at 2:00 p.m., the digital asset went from $ 0.22 to finish near session peaks, its negotiation range covering 5% of the lowest.

This decision came while the purchase activity systematically supported the token at higher levels, signaling resilience in a volatile environment.

The commercial dynamic highlighted this force, the volume passing to 69.68 million, well above the average of 24 hours of 37.42 million.

Institutional accumulation and extraordinary activity gusts – including a single peak of 4.87 million – have highlighted the aggressive positioning above key resistance thresholds.

On a shorter horizon, Hbar has recorded notable intra -day volatility. In the hour between 1:29 p.m. and 14:28 on September 3, the token gathered from $ 0.22 to a height session before stabilizing, reflecting conventional escape models with ascending stockings and persistent momentum.

With support holding more than $ 0.22, merchants will watch closely to see if Hbar can maintain its upward posture in the next negotiation period.

Technical indicators report continuous strength

- Hbar made solid support at $ 0.21 during opening sessions with a substantial volume of 69.68 million, considerably exceeding the average of 24 hours of 37.42 million.

- The critical resistance materialized at $ 0.22, awarded to the test several times during the night with an amplified volume, indicating a potential development of rupture.

- The structure of the market has displayed manual accumulation training with an upward low configuration.

- The explosions of volume during bullish movements at 8:00 p.m. and 9:00 p.m. on September 2 validated an authentic purchasing momentum rather than a speculative activity.

- Exceptional shares of volume reaching 4.87 million at 13:43 confirmed the institutional positioning above the pivot threshold of $ 0.22.

- The cryptocurrency presented a classic rupture dynamic with a low ascending structure and a sustained purchase pressure during the ascending phases.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.