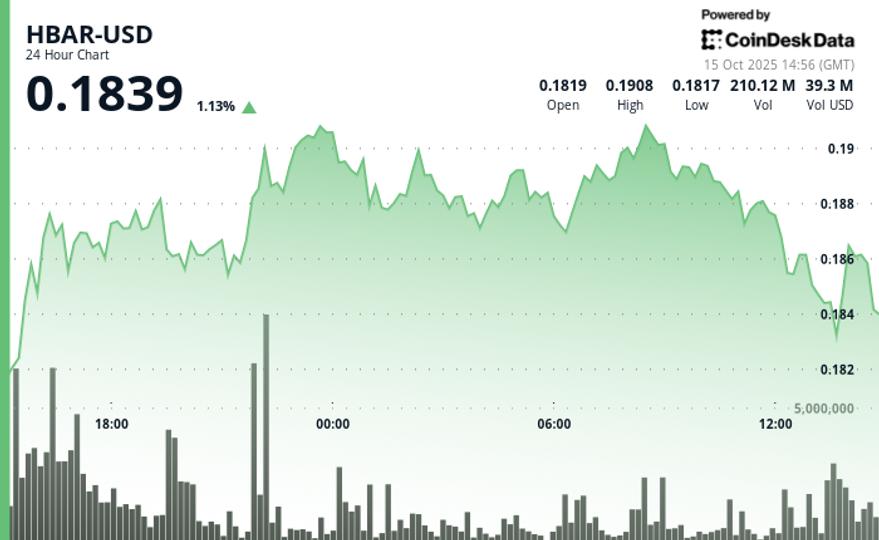

Hedera’s HBAR token saw sharp swings between $0.18 and $0.19 over a volatile 23-hour window from October 14-15, with prices moving within a 5% range. The token rose from $0.18 to a high of $0.19 before hitting resistance, eventually settling near $0.19 for a modest 2% gain. Support around $0.19 remained firm despite several tests, while selling pressure limited the upside momentum.

Technical indicators point towards consolidation, with trading volumes showing distribution at intraday highs as traders booked profits. The stalemate between buyers and sellers suggests near-term uncertainty, even if support remains intact.

Across the market, geopolitical tensions and evolving trade policies continued to weigh on investor confidence. Global disruptions to capital flows have raised concerns for blockchain payment networks like Hedera, which rely on cross-border stability.

HBAR’s saw trading highlights crypto’s growing sensitivity to macroeconomic conditions. The token’s late-session rally highlighted how traders are grappling with external pressures, as risk appetite remains fragile across digital assets.

Key technical levels emerge

- The trading band spans $0.009, representing a 5% gap between the high of $0.192 and the low of $0.181.

- Strong resistance forms near $0.19 with several unsuccessful breakout attempts

- The critical support zone anchors around $0.19 to $0.19 through repeated and successful testing.

- Volume explodes beyond 8.9 million during sales phase at 1:48 p.m.

- The last hour shows the classic support-resistance dynamic during the recovery movement

- A consolidation mode emerges with a bearish bias which becomes more pronounced until the close of the session.

- High volume at key levels signals institutional participation during breakouts and retests

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.