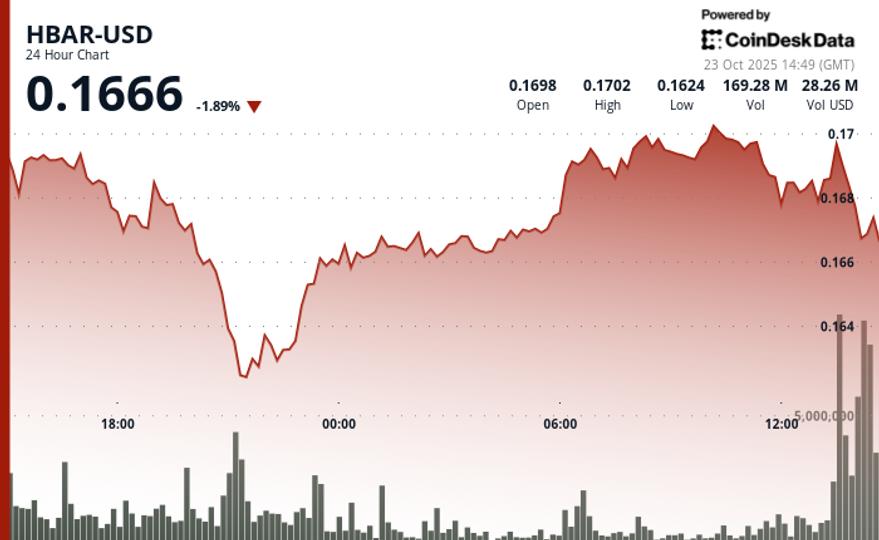

HBAR slipped 1.4% on Tuesday as bearish momentum intensified, pushing the token from $0.1698 to $0.1675. The move follows a failed attempt to reclaim the $0.1700 resistance level, with sellers pushing prices below key support at $0.1650. Trading volume surged 68% above its 24-hour average to 105.45 million tokens around 9:00 p.m. UTC, coinciding with the decisive breakout that confirmed bearish control.

Intraday volatility reached 4.9% as HBAR price moved within a range of $0.0084. Short-term data showed a sharp rejection from the $0.1690-$0.1697 area, which now acts as resistance after repeated failures to maintain bullish momentum. The subsequent drop towards $0.1676 solidified a bearish reversal trend, signaling weakening market sentiment.

Technical factors remain in focus with limited fundamental catalysts for action. The inability to recover above $0.1700, coupled with volume-backed support breaks, has moved the structure firmly to the downside. Traders are watching $0.1690 for signs of a reversal, while continued weakness below $0.1650 could open the way to the next support near $0.1620.

A brief bounce to $0.1675 on low volume only suggests a technical retracement rather than a sustained recovery. Unless buying pressure builds significantly, HBAR’s near-term outlook remains tilted toward further declines.

Key technical levels signal bearish structure for HBAR

- Support/resistance analysis

- Primary resistance: $0.1690 to $0.1700 area after several unsuccessful escape attempts

- Critical support for $0.1650 broken during high volume movements, now acting as resistance when retesting

- Secondary support to $0.1620where absorption of institutional volume previously took place

- Volume analysis

- Peak institutional volume: 105.45 million tokens, 68% above the SMA 24 hours a day, confirming the support outage

- Decreased volume at recovery until $0.1675 signals low buying interest

- Volume trends indicate distributionand not an accumulation, at current price levels

- Chart templates

- Bearish reversal confirmed with higher highs and lower lows

- Failed escape above $0.1700 proposed a sale

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.