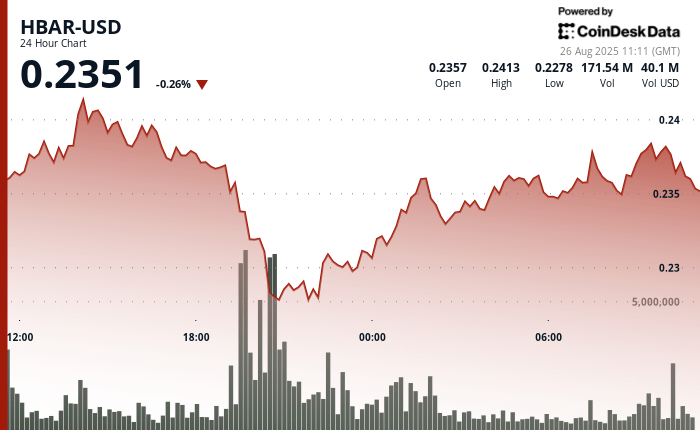

The Hedera Hbar token experienced net fluctuations during the last negotiation session, with an action of prices reflecting both a high sale pressure and signs of institutional support. During the window from 11 p.m. from August 25 from August 25 to 26 at 10:00 a.m., Hbar exchanged in a range of $ 0.014 between $ 0.242 and $ 0.228, for an intraday move of 5.83%. The most notable volatility occurred from 7:00 p.m. to 8:00 p.m. on August 25, when the token went from $ 0.237 to $ 0.228 in a steep sale.

This drop, however, coincided with an increase in volume to 169.5 million tokens, suggesting that large buyers intervened at $ 0.228. The sudden influx of the request stabilized the prices and prepared the land for a rebound, Hbar covering $ 0.237 by the closing of the session. Market observers underline this dynamic as an example of sales focused on capitulation, creating accumulation opportunities.

At the last hour of negotiation on August 26, Momentum tilted modestly in favor of the bulls. Hbar increased by 0.11% from $ 0.237359 to $ 0.2,373,96 despite intrajournial drops as low as $ 0.236270. Price resilience above 0.236300 has highlighted an emerging support area, where the purchase activity systematically absorbed downward pressure.

The consolidation between $ 0.236300 and $ 0.238270 has established a clear short -term range. Institutional flows seeming to strengthen the lower limit, analysts suggest that the market could prepare for its next decisive decision. The question of whether Hbar can break beyond the resistance at $ 0.238270 could determine if this rebound evolves towards a wider bull.

Technical indicators analysis

- The volume increases to 169.5 million during August 25, 19: 00 to 20: 00 Confirmed correction Formation Robust support at the price level of $ 0.228

- Rapid price recovery from $ 0.228 to $ 0.237 validates institutional accumulation activity and underlying market strength

- Exchanges linked to the range between $ 0.236,300 and $ 0.238270 indicate the previous accumulation phase.

- Validation of repeated support at $ 0.236300 strengthens a strong institutional conviction for purchase at these price levels

- The resistance meeting at $ 0.238270 establishes clear parameters for expectations of short -term price action

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.