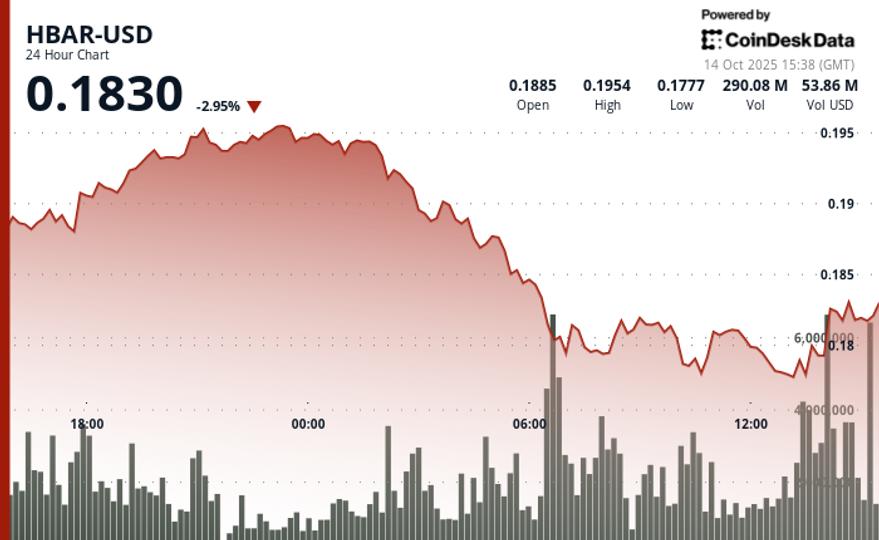

HBAR displayed significant volatility in the 24-hour period ending October 14, swinging nearly 9% as traders faced sharp market swings.

The token rose from $0.19 to a low near $0.18 before experiencing a late recovery that brought prices back to the $0.18 area. The most decisive reversal occurred in the final hour of trading, where HBAR rebounded 1% from support, supported by a surge in volume that exceeded 6.3 million trades.

The sharp rise in activity between 1:37 p.m. UTC and 1:46 p.m. UTC suggests strong accumulation as investors intervene at discounted levels. Chart data indicates a clear double bottom forming in the $0.18 range – a technical signal often associated with bullish reversals.

The ensuing breakout breached near-term resistance levels, hinting at further momentum and a potential continuation towards higher price targets.

Despite broader market turbulence caused by ongoing geopolitical and trade tensions, HBAR has demonstrated resilience.

This rebound highlights continued institutional interest in blockchain assets, even as traditional markets experience increased volatility. With buying pressure intensifying and technical indicators flashing recovery signals, HBAR’s recent price action suggests that the token could be positioned for additional gains in the near term.

Technical indicators highlight market dynamics

- HBAR formed resistance near the $0.20 to $0.20 levels before moving into a sustained downtrend.

- High volume of 174.69 million at 06:00 on October 14 validated the bearish momentum.

- The formation of a double bottom appeared around the $0.18 to $0.18 support levels.

- The increase in volume exceeded 6.30 million during the 1:37 p.m. to 1:46 p.m. period, signaling buying interest.

- The overall $0.02 range represents a substantial 9% change, highlighting increased volatility.

- Critical support established at $0.18 to $0.18 range, determining short-term directional bias.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.