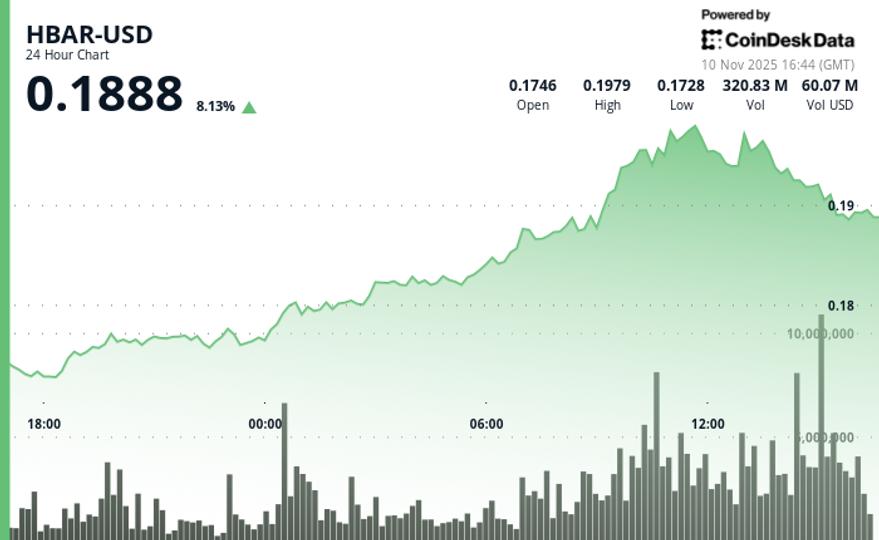

HBAR rose 4.62% to $0.188, outperforming the broader crypto market as trading volume soared 24.2% above its weekly average.

Price action during the session highlighted genuine institutional participation rather than retail speculation. HBAR’s 6.37% outperformance versus the CD5 benchmark highlighted strong asset-specific demand catalysts.

Technically, HBAR moved higher from $0.1736 to $0.1894, forming ascending trendlines marked by higher lows and demonstrating strong bullish momentum. The $0.0255 total range reflects 13.2% volatility, while volume reached 215.6 million, confirming a decisive breakout above the $0.1950 resistance zone. Strong near-term support consolidated near $0.1880, suggesting a healthy retracement structure in an overall bullish setup.

However, the last hour saw a sharp reversal as institutional profit-taking triggered a technical correction. The price moved from a high of $0.1925 to $0.1892, surpassing support at $0.1911 on nearly triple the average hourly volume.

The failed attempt to break above $0.1920 established lower highs and bearish intraday channels, with temporary support now forming near $0.1890 – a level traders should watch closely as the market digests recent gains.

Key technical levels signal mixed outlook for HBAR

Support/Resistance: The main support lies at $0.1880 with resistance at the $0.1920 to $0.1950 area.

Volume analysis: An increase of 24.2% above the weekly average confirms institutional flows, while an hourly increase of 10.8 million shows profit taking.

Chart templates: Ascending trendlines developed before a late reversal created a falling channel structure

Targets and risk/reward: A break above $0.1950 targets the $0.200 level, while the risk of failure of $0.1880 decreases towards $0.1750.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.