Hbar maintains regular gains in the midst of institutional support

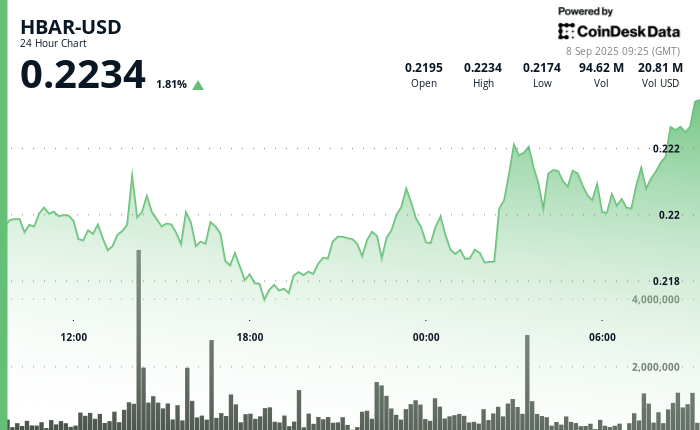

The Hedera Hbar token posted stable gains in a section from 11 p.m. on September 7 from 9:00 a.m. to September 8 at 8:00 a.m., trading in a tight band of $ 0.0042. Price action reflected only 2% volatility between the key support of $ 0.22 and resistance levels, highlighting a period of relative stability for digital assets focused on the company.

Institutional liquidity overvoltage price

Market data showed a significant increase in institutional participation during the afternoon session of September 7. The negotiation volumes increased to 67.40 million units to 14: 00 – much higher than the average of 24 hours of 27.33 million, while buyers intervened to provide liquidity at $ 0.22. This intervention helped to anchor the price of the token after a brief decrease for 6:00 p.m.

The interest of companies leads to a renewed momentum

A new business activity appeared at the early hours of September 8, with an obvious renewed request from 2:00 a.m. Hbar closed the period to $ 0.22, marking a modest advance of 1%. Analysts suggest that the model highlights growing confidence among business adopters of the great distributed book technology, Hedera positioning himself as a cutting -edge solution for business blockchain applications.

Trading model analysis

- Hbar established technical support at $ 0.22 after an initial advance at the same level at 07:28, with a consolidation of subsequent prices forming an upward tendency channel.

- The token has maintained an interest in institutional purchase coherent greater than 600,000 units in several trading intervals during the one hour analysis window.

- A derivation greater than $ 0.22 occurred in the final negotiation minutes, suggesting a continuous institutional accumulation and a potential for appreciation of additional prices.

- The cutting -edge volume activity reached 3.23 million units at 07:35, reflecting increased institutional participation and market liquidity.

- The negotiation range of $ 0.0042 represented an intra -day volatility of 2%, demonstrating a relatively stable price action despite larger market uncertainties.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.